In recent years, the global business community has been abuzz with discussions surrounding the potential of the e-commerce market. Notably, one of the most promising regions displaying significant e-commerce growth is the Gulf Cooperation Council (GCC).

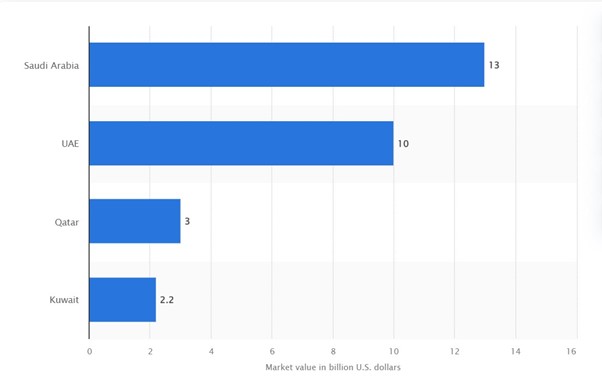

The market size of the e-commerce industry in the GCC in 2021, by country, was as follows:

According to the Dubai CommerCity report on the MEASA E-commerce landscape, the annual e-commerce growth for the GCC from 2019 to 2022 reached an impressive 33%. What’s even more noteworthy is that this growth was nearly double the global rate of 17%. The GCC’s prominent members, Saudi Arabia and the UAE, grew at 39% and 38%, respectively. With such staggering numbers, one might wonder: Why is this region not on the radar of many US and UK brands?

Understanding the Current Landscape

The GCC, comprising Saudi Arabia, Kuwait, the UAE, Qatar, Bahrain, and Oman, currently accounts for a meager 1.8% of GDP in e-commerce, as reported by Alpen Capital’s 2022 retail industry. While it might seem diminutive when compared to titans like the EU, US, Canada, and the UK, it’s crucial to focus on the underlying growth narrative. The total e-commerce revenue in the GCC is forecasted to touch US$50 billion by 2025, growing at a CAGR of 10.95% from 2023-2027. This growth is supported by an increasing number of online shoppers, reaching almost 60%.

However, there’s a perception challenge. For several Western brands, the region’s relatively small share in global B2C e-commerce sales doesn’t seem to justify the operational, logistical, and marketing investments required to enter these markets.

The Local Dynamics and the Role of Global Players

Local enterprises, such as Noon (Saudi) and Desertcart (UAE), have a significant foothold in the market. Amazon’s acquisition of Souq.com in 2017 marked a watershed moment, emphasizing the potential of the GCC’s e-commerce market to global players. The advantage for these local companies is their innate understanding of regional intricacies, languages, and consumer predilections. This localized knowledge positions them as attractive allies for global entities seeking a piece of the GCC e-commerce pie.

Furthermore, the rise of fintech and logistics startups in the region, exemplified by the financing of Tamara, suggests a maturing ecosystem supporting e-commerce growth.

Here is a compiled list of the most popular online market websites in the GCC:

- Amazon: Originally Souq.com from the region, it was one of the largest e-commerce platforms. Amazon acquired it in 2017 and rebranded it to Amazon.ae in the UAE and Amazon.sa in Saudi Arabia.

- Noon.com: A major e-commerce platform headquartered in Dubai, UAE, it operates in several GCC countries and offers a wide range of products.

- Desertcart: Primarily serving the UAE, it provides a platform for purchasing international products.

- Namshi: Focusing predominantly on fashion, it’s popular in several GCC countries.

- Jawwy: This platform is primarily known in Saudi Arabia and offers electronics, fashion, and more.

- Carrefour: While globally known as a supermarket chain, its online platform in the GCC offers groceries, electronics, and more.

- Sharaf DG: An electronics-focused e-commerce platform popular in the UAE and Bahrain.

- Xcite: Based in Kuwait, it offers electronics and a range of other products.

- Mumzworld: Focusing on products for moms, babies, and children, it serves the entire GCC.

- Ounass: A luxury e-commerce platform offering high-end fashion, beauty, and lifestyle products in the GCC.

- Sivvi: Predominantly a fashion e-commerce platform popular in the UAE and Saudi Arabia.

Product Landscape and Consumer Behaviour

The GCC eCommerce sector is witnessing substantial growth due to evolving consumer habits, digital modernization efforts, and a rise in accessible online payment methods. Key market tendencies to note are:

- Mobile shopping: The popularity of mobile commerce (m-commerce) is on the rise in the Middle East, with an increasing consumer base turning to their smartphones for online shopping.

- Social commerce: Platforms like Instagram and Facebook are becoming more prevalent as avenues for eCommerce transactions.

- Online payment solutions: The proliferation of online payment methods, including credit cards, digital wallets, and mobile transactions, has simplified the online shopping experience for consumers.

So, without further ado, let’s delve into some of the GCC e-commerce statistics:

GCC e-commerce statistics

Internet penetration:

According to a report released by Orient Planet Research, GCC nations witnessed an impressive 98% increase in the number of internet users in 2021. Additionally, the number of regional mobile users increased 137.66%, underscoring the remarkable growth in digital connectivity.

Based off the Gulf ICT Use Index and data sourced from the International Telecommunications Union, the penetration of internet and telecommunications services in GCC nations far exceeds the global norm. Remarkably, it stands among the highest globally across all regions. In GCC countries, the ratio of internet users to the population has surged to 98.2%, whereas the worldwide average lags significantly at 63%.

Data also indicates that, on average, the number of subscribers in fixed broadband services relative to the population was 20.88% in the GCC countries.

To break down the figures, the UAE took the first spot in the GCC ICT Use Index for 2021, achieving 5.43 points, followed by Kuwait with 3.74 points. Meanwhile, Saudi Arabia ranked third with 3.64 points; Qatar, fourth with 3.62 points; Oman, fifth with 3.49 points; and Bahrain, sixth with 3.38 points.

Credit cards

The GCC Financial Cards & Payments Market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 11.2% during the forecast period from 2023 to 2028. This growth is underpinned by various factors, including the burgeoning e-commerce sector, regulatory shifts in Islamic banking, a surge in international transaction volumes, a high rate of internet penetration, and an increasing need for credit facilities in the Gulf region.

Moreover, the forward-thinking initiatives spearheaded by governments in the UAE, Saudi Arabia, Qatar, and other nations to drive digitalization across various sectors have further fuelled the adoption of services such as mobile banking and internet banking. Consequently, the rising utilization of these digital financial services has led to a heightened demand for financial cards and payment solutions in the region.

The UAE is anticipated to acquire the largest market share during the forecast period. It owes principally to the country having numerous shopping complexes, the establishment of luxury brands, and plenty of things to shop for, stimulating the utilization of financial cards & payments to make transactions across locations conveniently.

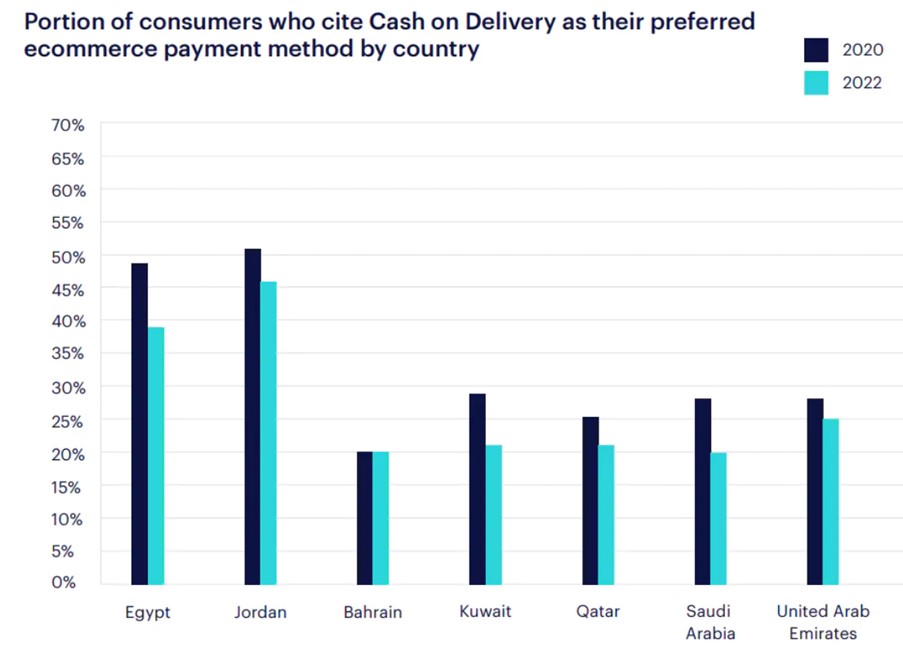

A study conducted by international fintech company checkout.com reveals some interesting trends in the payment landscape of the MENA region. As demonstrated above, whilst Egypt and Jordan’s reliance on cash on delivery remains high, the GCC countries are generally much less reliant on cash. Although the GCC remains “relatively cash-friendly”, with physical currency still playing a significant role in the digital economy, the gradual move away from cash on delivery is evident.

Additionally, the study highlighted a sustained increase in the adoption of digital wallets, with Qatar and Saudi Arabia showing particularly noteworthy growth in this area. Despite the Saudi government’s efforts to promote digital payments, it’s worth noting that in the youngest demographic, cash continues to be the preferred choice over card usage, although digital wallets still surpass cash in terms of overall preference for e-commerce payments.

Furthermore, the study points out that while cash on delivery has declined in most GCC nations (excluding Bahrain, where it remains prevalent in approximately 20% of transactions), it still enjoys popularity across the GCC when compared to Western counterparts.

Mobile Phone Penetration:

Today, most of the population in the GCC access the internet through their mobile devices with Bahrain leading the field with a penetration rate exceeding 97%, followed closely by the UAE which exceeded 96% in 2023.

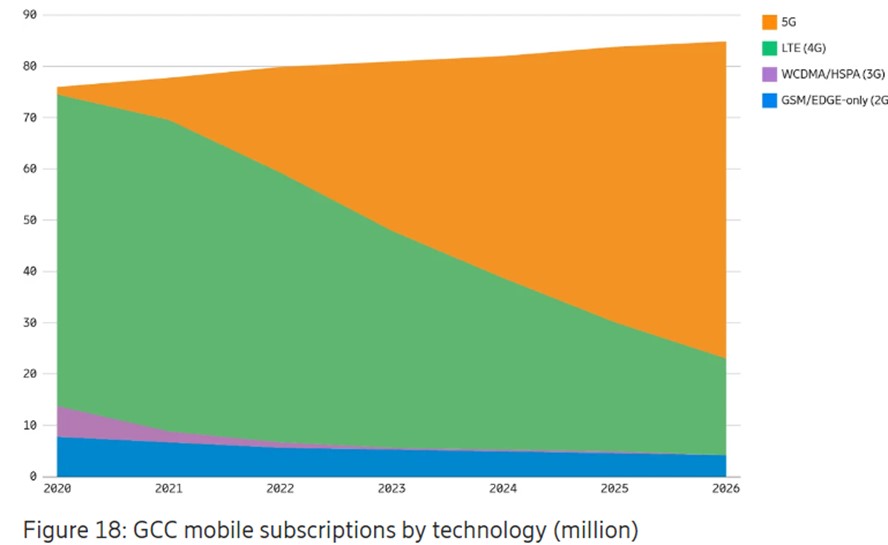

It is worthy to note that while 5G rates remain relatively low, operators in the GCC states are among the global leaders, with competition and government support triggering launches of some of the world’s first and fastest next-generation mobile networks. See the below chart for predicted 5G growth in the GCC:

E-commerce Product Preference

The MENA region, with the GCC at its core, has showcased consistent product preferences over the years. Fashion dominates, accounting for 38.7% of the UAE’s e-commerce revenue. Electronics and media follow closely, catering to a tech-savvy, young population, accounting for 19.9% of the e-commerce revenue in the GCC. Other booming categories include the following: kid supplies, grocery and personal care, and furniture and appliances.

The rapid adoption of mobile shopping, combined with the rising use of social commerce through platforms like Instagram and Facebook, accentuates the potential of the market. PwC’s survey indicates a 73% preference amongst buyers for online grocery shopping, further elucidating the changing consumer behaviour.

Challenges, Competition, and Future Potential

With internet penetration nearing 100% and a further 80% of users embracing online shopping, this region is a great target audience for new sellers. Couple this with an e-commerce opportunity that’s set to become a $50 billion market by 2025; there’s no reason why the GCC should remain overlooked.

However, while the GCC holds serious promise, challenges persist. The regulatory landscape governing e-commerce varies across countries, and brands need to navigate these complexities.

In light of this, policymakers have been pressing ahead to streamline and speed up clearance processes, accelerate delivery times, and add more storage options. They are also working to ensure the customer journey is as transparent and seamless as possible; the introduction of new consumer protection frameworks in the region has also supported the switch from cash to card.

The biggest opportunity that remains is around accessibility to products, particularly those from US and European brands – something for sellers to consider as they explore new markets and growth opportunities.

In conclusion, with the region’s ever-growing purchasing power of the population, supportive e-commerce initiatives from governments, and widespread connectivity, all points towards a thriving future for e-commerce in the GCC. With local and global players intensifying competition, it’s only a matter of time before the GCC e-commerce market realizes its full potential.

References:

https://abmagazine.accaglobal.com/global/articles/2023/apr/business/e-commerce-on-the-up-in-gcc.html

https://www.statista.com/outlook/dmo/ecommerce/gcc#revenue

https://www.statista.com/statistics/1366074/gcc-ecommerce-market-size-by-country/

https://virtocommerce.com/blog/ecommerce-in-middle-east-gcc

https://alpencapital.com/our-research.php

https://www.statista.com/outlook/dmo/ecommerce/gcc#social-commerce

https://www.marknteladvisors.com/research-library/gcc-financial-cards-payments-market.html

https://www.statista.com/topics/5338/smartphone-market-in-mena/#topicOverview

https://www.gsma.com/mobileeconomy/mena/

https://www.ericsson.com/en/reports-and-papers/mobility-report/closer-look/gcc