The Middle East is one of the fastest-growing e-commerce markets in the entire world. While it is still nowhere near as developed or complex as the markets in the United States or many countries in Europe, the region is experiencing an undeniable boom. It is estimated that online sales in the Middle East currently equal only a meager 4% of total retail revenue, as opposed to 15% in more developed regions. In the Gulf States, E-commerce revenue is expected to grow at a rate of nearly 11% annually between 2023 and 2027, reaching USD $49.78 billion annually by 2027, up from USD $32.85 billion in 2023. E-commerce in the Gulf States alone was estimated to quadruple from the $5 billion in profits seen in 2015 to $20 billion before 2020. There are some analysts that are even reporting estimated profits of $48.8 billion in 2021. Currently, almost 90% of online goods bought in the Middle East are still shipped from outside countries, but this is changing rapidly. As a result, there is huge potential for e-commerce profit during this modern age in the Middle East.

What has led to this Market Boom?

The Middle East has one of the youngest populations in the world, and now is the ideal time to target youth in the region. With a whopping total of 450 million people, more than 30% of the population in the Middle East are between the ages of 15 and 29. This is more prominent in specific countries including Egypt, Iraq, Lebanon, Morocco, Oman, Tunisia, Jordan, Algeria, and Saudi Arabia, where around 20% of the total population are between the ages of 15 and 24 years old. Young people are the fastest-growing demographic in this region, with a median age of 26.8 years old. With the majority of younger generations moving towards e-commerce and smartphone usage, the upward trend of e-commerce is to be expected. The Middle East, as well, has some of the largest per capita wealth globally.

Internet Penetration

Dispelling orientalist stereotypes that the Middle East is all desert and camels, reported internet statistics from the Middle East are staggering. Egypt and Turkey have made the top global rankings in the number of internet users. Egypt is 12th with 80.75 million users, comprising 73.88% of the total population. Turkey trails closely behind with the 15th biggest internet population in the world. There were a reported 71.38 million users in 2023, comprising 84.19% of the total population. These numbers are astounding, and they are only representative of a few countries in the Middle East. In Bahrain, 100% of the population was found to use the internet in 2023, ranking even higher than the United States and France.

Differences between Middle Eastern Countries

This is a general guide about the countries in the Middle East, that could potentially help you grow your business or receive more traction for your product. However, it is important to understand that although this is a general overview, there are differences which vary from country to country that one needs to consider. The status of e-commerce in Syria and Yemen, for example, is certainly different from that of Saudi Arabia and Dubai. As a general rule, countries in the Gulf region have more e-commerce penetration and countries located further North (besides Jordan) have not emerged in the market yet. Even Lebanon, a very developed country, has no e-commerce. Here is a page where you can find more country-specific information.

The Top E-Commerce Websites

The tremendous potential of this region as a market has caught the attention of numerous notable companies and businessmen who have chosen to open their e-commerce platforms. There are three main ones:

Amazon

Amazon is the 500-pound gorilla that entered the region in 2017 by buying Souq.com, the UAE-based online shopping platform founded by Ronaldo Mouchawar in 2017. Initially, Amazon kept Souq running as it was making changes only internally, but in 2019 we started to see external changes when Souq in the UAE rebranded as Amazon.ae. In fact, any internet user searching for the Souq.com will automatically be redirected to land on Amazon.ae. Given the quick success of Amazon’s venture into the Middle East market, the company also launched in Saudi Arabia in 2020 and Egypt in 2021, with the respective domain names Amazon.sa and Amazon.eg. In 2022, Amazon.ae rang in USD $496 million in net sales, followed by USD $242 million for Amazon.sa, and USD $196 million for Amazon.eg. Amazon consistently ranked within the top online sellers by net sales in the three operating countries, especially in the electronics market, where Amazon was the #1 online seller in Egypt, and the #2 online seller in Saudi Arabia and the UAE.

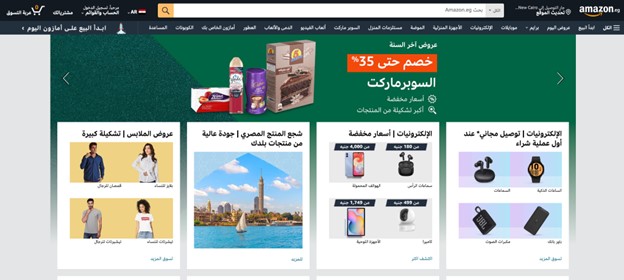

The home page of Amazon.eg, with default text in Arabic and a choice to search in English

The home page of Amazon.eg, with default text in Arabic and a choice to search in English

Amazon is also a major employer in the region, citing over 6,500 employees working in fulfillment centers and corporate offices in the UAE, Saudi Arabia, Egypt, Bahrain, Jordan, and Morocco. Despite Amazon’s presence in the region, there is still less selection on Middle Eastern Amazon sites compared to Amazon.com. so a large number of Arabs in the region prefer to have an Amazon.com account that they purchase from in the states and use a shipping forwarding company like Shop & Ship to forward their packages from a local address in the states to their Middle East address.

Trendyol

Trendyol, as Trendyol.com, led the ranks of e-commerce sites in the Middle East with the most visits in 2022. Founded in Turkey in 2010, this site offers a massive range of products such as fashion items, groceries, and electronics. With e-commerce net sales of USD $3,7267.9 million in 2022, this site has massive popularity not just within Turkey but throughout the Middle East. Although Trendyol only ships domestically, given that the Chinese AliBaba group is a majority shareholder of the company, international customers can purchase Trendyol brand items and have them shipped through AliBaba’s AliExpress platform. In Turkey, Trendyol owns a number of local offshoots like Trendyol Go, a grocery delivery service, and Dolap, a second-hand product trading platform.

Trendyol recently launched a fashion collection with AliExpress

Trendyol recently launched a fashion collection with AliExpress

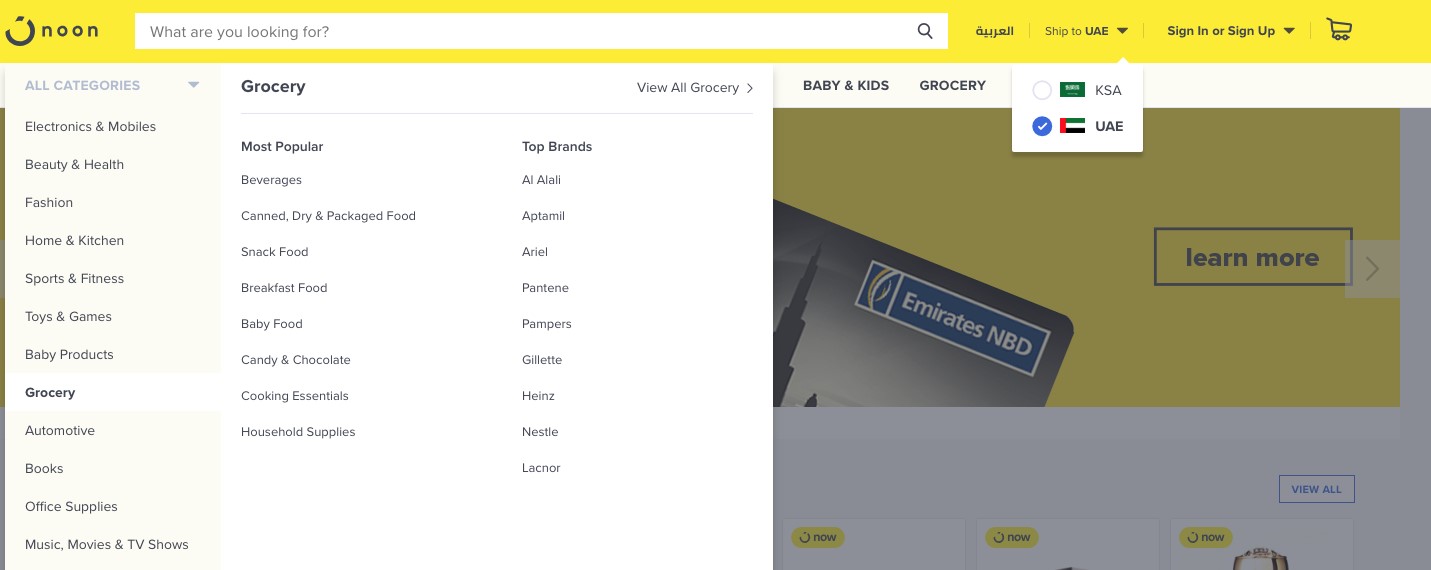

Noon

This e-commerce site is aiming to be the go-to site for e-commerce in the Middle East. Seeing a lot of potential in this business, investments have surpassed the billion-dollar mark. They eventually launched in the fall of 2017, slightly after Amazon made an announcement that they were officially entering the market. Noon has said their goal is “to shape a digital marketplace that is relevant to our local markets and serves as a growth platform for brick-and-mortar retailers.” The direct competition with Amazon is likely to create a price war and thus prove to benefit the consumers. Products purchased through Noon and shipped from overseas can also be easily returned to Noon with a full refund option, based on the terms and conditions. Currently, they only ship products to Saudi Arabia, the United Arab Emirates, and Egypt. However, there are plans to expand to additional countries throughout the Middle East.

Here are all the products that they offer and what their home screen looks like.

Wadi

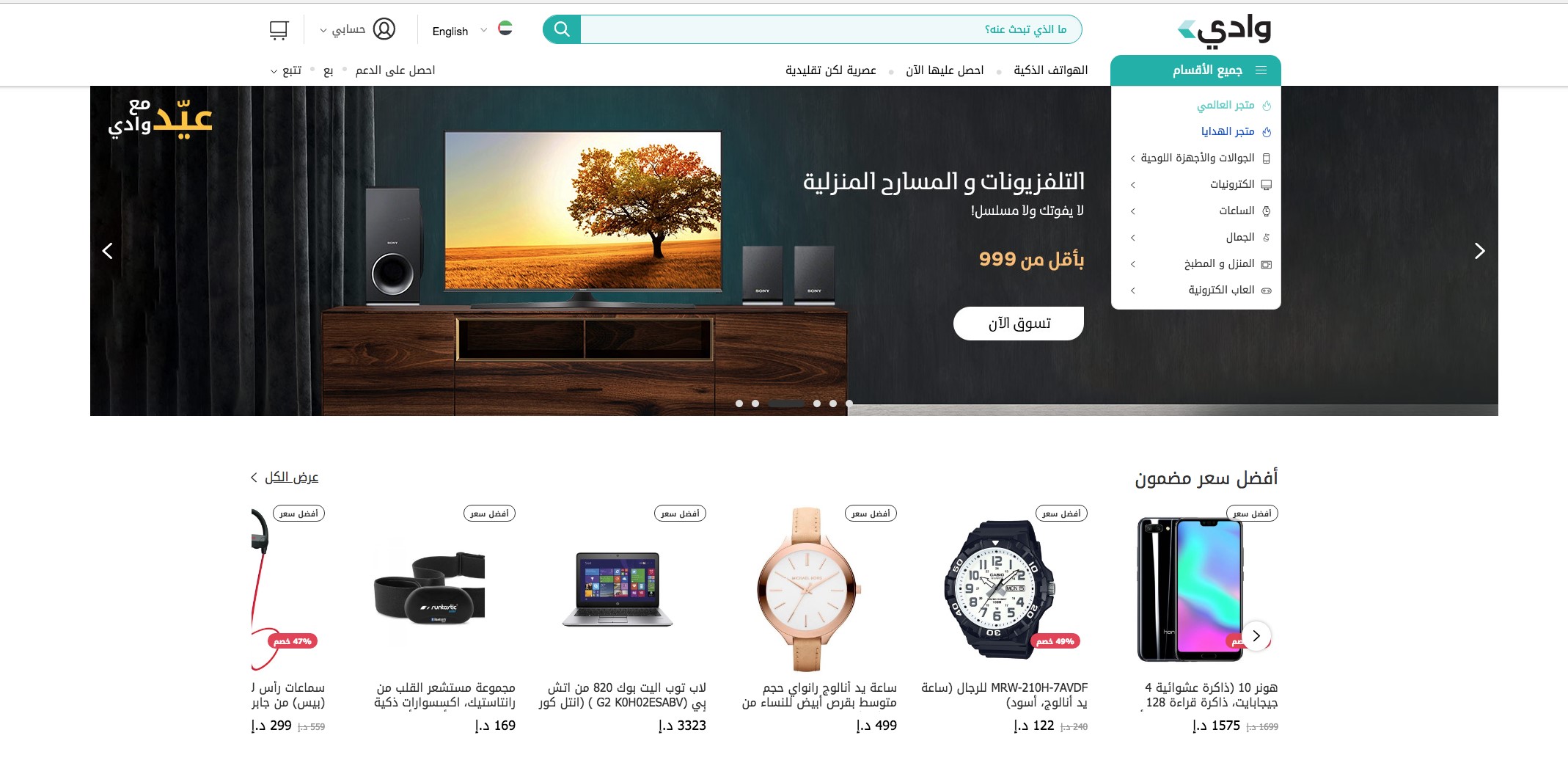

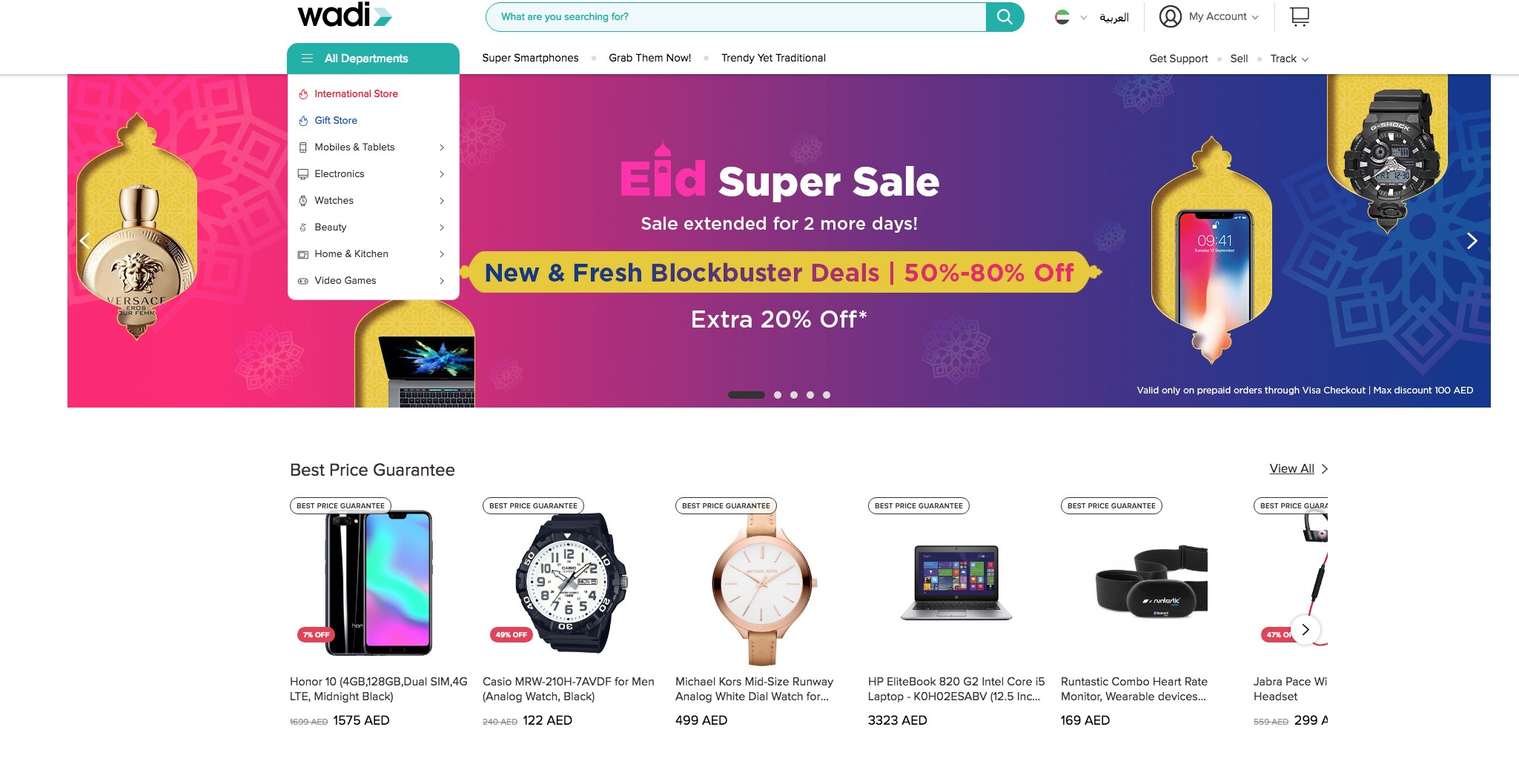

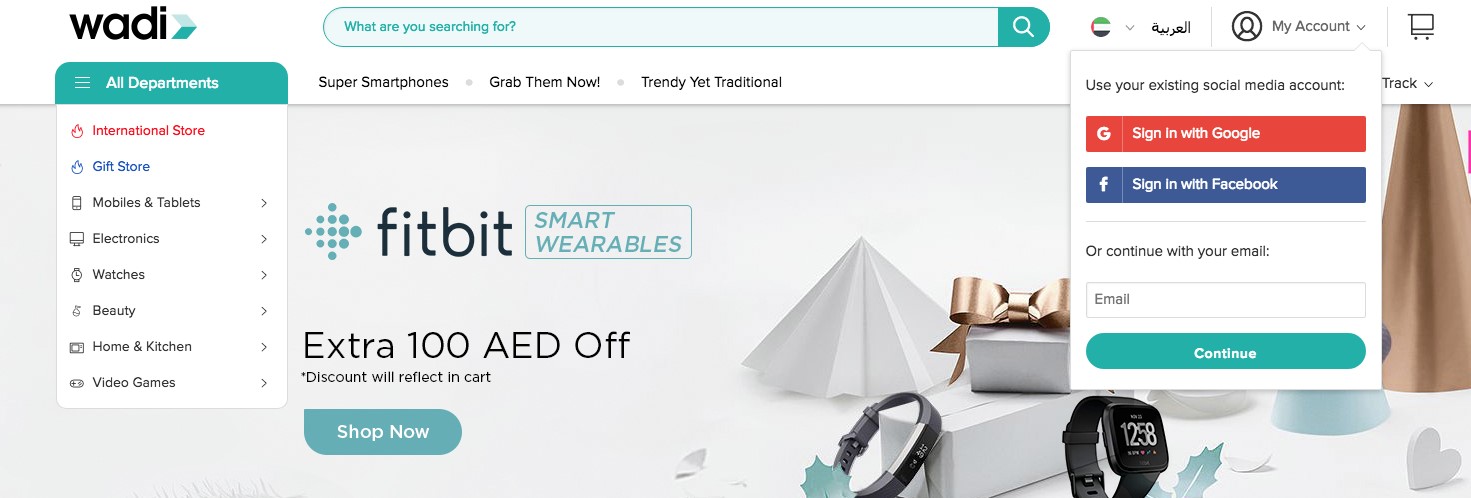

Though smaller than the previous two, this is the third most popular e-commerce website operating out of the Middle East. It was founded in 2015 by the Middle East Internet Group (MEIG), as a joint business between German internet platform Rocket Internet and South African telecommunications provider MTN. Right now, it serves customers living in the UAE, Saudi Arabia, Bahrain, Oman, and Kuwait but is exploring possibilities of expanding. The company grew six-fold last year and sells over 550,000 total products.

The site in Arabic

Which of these sites is the best?

Each of these top e-commerce sites has different prices for different goods. A study by a business magazine did a sample study of electronics on each platform to determine which offered the best prices. They found that besides laptops where Wadi was clearly the cheapest, the three companies offered the same amount of different categories in which their platform were the cheapest. Online, there are both positive and negative reviews of each platform. It will be a very interesting question to see if one of them prevails as the leader. However, for now, those in the Middle East can be thankful that the competition between the platforms is keeping the prices lower.

Though these are the most popular e-commerce sites, there are a number of smaller ones that are more niche as well. The language of the site depends on the country and the languages that are spoken there. In all countries, this means Arabic as a base, but second languages differ from country to country. Many other sites use English. In Morocco, for example, they use French.

Notable ones include:

Namshi

A retail clothing giant that operates primarily in Saudi Arabia, Oman, the United Arab Emirates, Kuwait, and Bahrain. They offer a variety of popular brands ranging from Nike in Sportswear to Maybelline in Cosmetics. They also have a number of homeware, stationery, and technology products as well.

Wysada

This luxury furniture and Home Decor platform was launched in Jordan in 2013. The site provides bed and bath equipment, décor, furniture, kitchen appliances, and outdoor equipment. They ship to Jordan, Saudi Arabia, UAE, and even America.

Mumzworld

This site is advertised as the “#1 Mother, Baby, and Child site in the Middle East”. They ship to “the UAE (Dubai, Abu Dhabi, Sharjah), Saudi Arabia (Riyadh, Jeddah, Khobar/DMM), Qatar (Doha), Kuwait, Bahrain, Oman, Jordan (Amman), Lebanon and all over the world”

MarkaVIP

Markavıp is a luxury community shopping application tailored to the Middle Eastern market. The concept of the company started off as a website founded by Ahmed Alkhatib, who spent over a decade in the e-commerce industry in Silicon Valley. The app operates by promoting flash sales in eight Middle Eastern countries: Jordan, Saudi Arabia, UAE, Qatar, Kuwait, Lebanon, Bahrain, and Oman. They have over 1.5 million likes on Facebook.

BuyLebanese.com

This e-commerce platform sells various sweet items including region-specific candies, pastries, baklava, coffee and various other edible items to more than 125 countries worldwide, not just in the Middle East.

Country-Specific Sites

As we have learned that the markets differ in each country, it is also important to know that there are different e-commerce sites for each country. For example Dubizzle is a Craigslist similar site that focuses on Dubai and the United Arab Emirates.

Web V.S. Mobile

As smartphone penetration rapidly proliferates through the area, many e-commerce sites have transitioned over to mobile applications to maintain a level of interest. Ikea revealed its mobile app to the region in 2013 and Souq.com launched its multi-language app in 2014. Though web commerce still is more popular, more customers are rapidly moving towards e-commerce as well. Even brick and mortar institutions are moving towards mobile platforms.

Problems with E-Commerce

1. Delivery Methods

The Middle East as a whole presents unusual challenges for delivery options as many countries don’t have postal codes or a traditional mail courier system. Many other streets are unnamed, have informal names, or have names in multiple languages as a legacy from colonialism. Thus, it has been difficult for e-commerce companies to figure out how to tackle these very real challenges. However, it has also led to a lot of innovation in the region as young, entrepreneurial spirits are stepping up to this challenge. Startups like Fetchr have implemented innovations such as an exact location pinpointing on a map as a target of delivery, instead of using addresses as Is the practice in the United States.

2. Payment Methods

Each country has its own relationship with physical/ virtual currency, and it is important to understand that one does not necessarily work for all. For example, in the United Arab Emirates credit cards are widespread and thus traditional e-commerce transactions are not a problem. Other countries, however, do not have widespread credit cards and prefer (or are only able) to use cash. In 2015, the World Bank estimated more than 85 million adults in the region remain without a banking institution. This is for a variety of reasons. In Egypt, for example, many people are unable to meet the minimum deposit required to open a bank account. In Saudi Arabia, many credit cards do not comply with Sharia Law rules of Islamic banking and finance. Thus, e-commerce companies have been forced to develop various other systems of payment to ensure successful transactions. Similar to problems with delivery infrastructure, innovation has been key in resolving these problems.

An example of a Noon.com promotion for using bank cards, aiming to get more people away from cash transactions.

3. Fraud Holds

One of the biggest problems in several countries across the Middle East for U.S. companies is the credit card fraud, especially for high-cost transactions. This is a huge problem in Morocco but exists elsewhere too like Egypt. Often, people find their cards being rejected by companies in the United States because of the risk of fraud.

4. Warehouse Storage

One of the biggest problems that e-commerce sites have in the Middle East deals with storing and shipping problems across borders. In the United States, ordering from Amazon is easy because you are likely to receive your product from one of Amazon’s many warehouses across the country. However, with these regional operating sites, goods are sourced from the retailer and sellers in different countries themselves, which makes the logistics of sourcing and moving goods difficult and potentially risky if there is any problem on the retailer’s end.

5. Cash Economy

The biggest problem e-commerce companies have had to overcome deals with the large percentage of the population that still only uses cash. Companies were faced with a backlash when trying to get customers to pay cash before their goods were shipped, but many felt as though this was a scam. They then moved to the idea of customers paying cash at the time of delivery, but this was then a problem for the sellers as they were losing significant amounts of money due to shipping costs and the delay of the money reaching the account. MasterCard conducted surveys on the shopping behavior of Middle East consumers in 2015. They found that 80% of e-commerce in the Middle East is conducted with cash-on-delivery. Though this is changing, it is still a huge problem for businesses.

Here you can see the cash symbol for transactions that e-commerce companies in the West do not have on their websites.

6. Prevalent Mall Culture

Although we are seeing this boom, it is important to note that it is extremely unlikely that e-commerce will completely replace malls. The Middle East is known for its unique mall culture as a way of life. Especially in the Gulf Countries, malls offer a full package experience, transcending what is considered as a traditional mall experience in the West. Malls in the Middle East provide a full entertainment and retail experience, from movie theaters, to aquariums, theme parks, to ski hills and thousands of shops. Especially given the influence of Islam and the impermissibility of alcohol in many places, spending Friday nights with your friends and family at a mall is a common experience. In 2014, the Dubai Mall alone could accommodate 80 million visitors in total. It is accurate to say that e-commerce will not fully replace the concept of a mall, but instead join in to create robust investment and business opportunities in a multitude of fashions. Currently, only 15% of total businesses in the Middle East have any sort of online presence. Although we are beginning to see a widespread emergence of deals.

Here is an example of a deal on noon.com teaming up with traditional brick and mortar businesses, a trend that is become traditionally common

E-commerce Marketing

Seasonal Promotions

Seasonal Promotion Times

Religion is the organizing aspect of many people’s lives in the Middle East, so holidays can be a large factor in dictating behavior during certain periods of the year. Similar to trends of buying gifts around Christmas, intimate gifts around Valentine’s Day, and large amounts of food for Thanksgiving, there are three main commercial holidays in the Middle East.

1. The first is the holy month of Ramadan. As this is one of the five pillars of Islam, Muslims fast from sunrise to sunset. The total month is a sacred time to reflect, pray, and give, as well as spend time with friends and family. After the sun sets, giant groups of loved ones feast and break their fast together. Because of these traits, it has seen large commercialization from almost all companies in the Middle East.

An example of a Ramadan heading for an e-commerce site. Read our comprehensive Ramadan marketing guide here.

2. The second is Eid al Fitr. Although this is technically related to Ramadan because it is the last day of the holy month. It is considered the most recognizable day of Ramadan and thus there are many traditions that go alongside it. Wearing one’s finest clothing, giving fancy gifts, and visiting family are all a part of this period. It has a very large online marketing presence.

Here is a generalized e-commerce Eid al Fitr advert with word “Ramadan” in the lower right-hand corner and the imagery of the lanterns

3. Eid al Adha is considered “the greater Eid” from the one discussed above. It is a time to celebrate sacrifice and devotion. It has similar traditions for gifts and presents for loved ones. It has additionally become a very commercialized opportunity for retailers throughout the Middle East.

For example, here is a Wadi.com advertisement offering discounted goods for Eid al Adha 2018. You can see how the ad focuses on giving nice gifts such as electronics and wristwatches, true to the way most people celebrate the holiday. Read our comprehensive Eid al Adha marketing guide here

Eid ads all over e-commerce sites

Social Media

According to trends of internet penetration and mobile usage, the Middle East is experiencing a similar widespread propensity towards social media usage. These numbers are directly connected with e-commerce as people are choosing to have online accounts and share information online, representing a shift towards trusting the internet and online connectivity. It also represents an e-commerce platform to advertise on.

Instagram usage is high in the region with 63 million users in total, representing about 10% of global users for the platform. This is significant considering population-wise, the Middle East makes up only 3%. Snapchat is also prevalent in the region with an estimated 33 million users. As a result of its popularity, in 2017, Snapchat opened its first Middle East office in Dubai in order to have a better relationship with news platforms and advertisers in the region. YouTube usage in the Middle East is extremely high, ranked second in the world for the number of daily views. Saudi Arabia is currently the biggest adopter of social media with a 32% year by year total increase across all platforms for users.

Social media plays a pivotal role in expanding e-commerce as it builds brands’ value through word of mouth. Sites such as Twitter, YouTube, and Facebook have all been instrumental in introducing e-commerce through people’s networks. The Middle East is a hotspot for “Instagram influencers” who promote goods through e-commerce with their celebrity status.

Another social media site that has reinforced the popularity of e-commerce in the Middle East is TikTok. With its rapid growth over the past couple years, TikTok has become a hub for e-commerce sales, granted that brands can easily link out to external sites. TikTok is the trendsetter for all that concerns fashion and skincare, and it is no surprise that it has become a key conduit for online sales in the Middle East region.

Huda Beauty is a makeup artist and entrepreneur based out of Dubai who advertises her products through American e-commerce websites.

Here is an example of Huda Beauty advertising on Sephora’s e-commerce platform.

Most Popular Goods

Airplane tickets and hotel reservations are currently the biggest spend for online shoppers in the Middle East. Cheap, convenient airfare that you can purchase with the click of a button has attracted consumers throughout the Middle East, but especially in Saudi Arabia. This shows that the region is almost completely done with travel agents and agencies and are becoming more comfortable on the internet. It also shows that since those who can afford airplane tickets and hotels are choosing to make online purchases, there is a definite transition towards other forms of e-commerce.

The second most common thing to buy is clothing/ footwear/ accessories, followed by electronics.

Additional Acceleration of the E-Commerce Market

There are several special unique projects that have been developed with the purpose of bolstering e-commerce in the region. The Dubai CommerCity in the Umm Ramool area in the city became the first free zone dedicated especially to e-commerce in the whole region. It is a 2.1-million square feet joint venture between two large Asset Management Groups, Dafza and Wasl. Its goal is to create an environment that encourages creativity and makes the region more alluring for foreign investment and other innovation.

Another aspect that would bolster e-commerce in the region are various e-Governance initiatives. Local governments have in the process of moving their traditional paper services online such as vehicle registration, passport applications, and other more personalized services. Familiarizing citizens with online services is creating a trust for them about the benefits of online services and the minimized risks. This has been very apparent in Dubai and Qatar.

Potential

All six of the Middle Eastern Gulf Countries are within the top 34 wealthiest nations in the world. Qatar, named the wealthiest country in the world, had a GDP in 2013 of $105,091 per person. Middle Eastern consumers also have the highest per capita spending on luxury products. It is clear that with increasing internet penetration, emerging technologies, wealth, and innovation that this market will be ever more rapidly increasing. It is fair to say the market opportunities are still relatively undiscovered. For retailers, innovators, investors, and marketers, there is significant potential for you. It is imperative that you understand the intricacies of this business.

Written by: Jennifer Lundt

Sources:

http://www.worldbank.org/en/region/mena

http://fortune.com/2017/10/02/this-middle-eastern-e-retailer-is-taking-on-amazon/

https://www.menabytes.com/souq-noon-wadi/

https://www.arabianbusiness.com/qatar-named-world-s-richest-country-uae-also-in-top-10-599852.html

https://dynamicxperts.com/special-ramadan-offers/

https://www.zdnet.com/article/whats-driving-middle-easts-rush-to-social-media/

https://www.statista.com/statistics/1379296/mena-retail-ecommerce-sales-ratio-to-total-retail-sales/

https://www.practicalecommerce.com/charts-u-s-retail-ecommerce-sales

https://en.wikipedia.org/wiki/List_of_Middle_Eastern_countries_by_population

https://www.arabbarometer.org/2019/09/youth-in-the-middle-east-and-north-africa/

https://explodingtopics.com/blog/countries-internet-users

https://datacommons.org/place/country/BHR/

https://virtocommerce.com/blog/ecommerce-in-middle-east-gcc

https://en.wikipedia.org/wiki/Trendyol

https://www.bigcommerce.com/articles/omnichannel-retail/tiktok-ecommerce/

Jordan Boshers

Jordan Boshers is the Chief Digital Strategist at IstiZada, a digital agency that helps companies market to Arabs. He has 12+ years of experience running successful digital marketing campaigns in the Arab world. His insights into Arabic SEO helped him grow previously unknown websites to dominate Arabic niches on Google including growing one site from 0 to more than 2.5 million users monthly. Jordan has consulted for hundreds of companies including helping corporations like Amazon, Berlitz, and Exxon Mobil with their Arabic digital marketing. Learn more here or on LinkedIn.

View all posts by Jordan Boshers