Updated on:

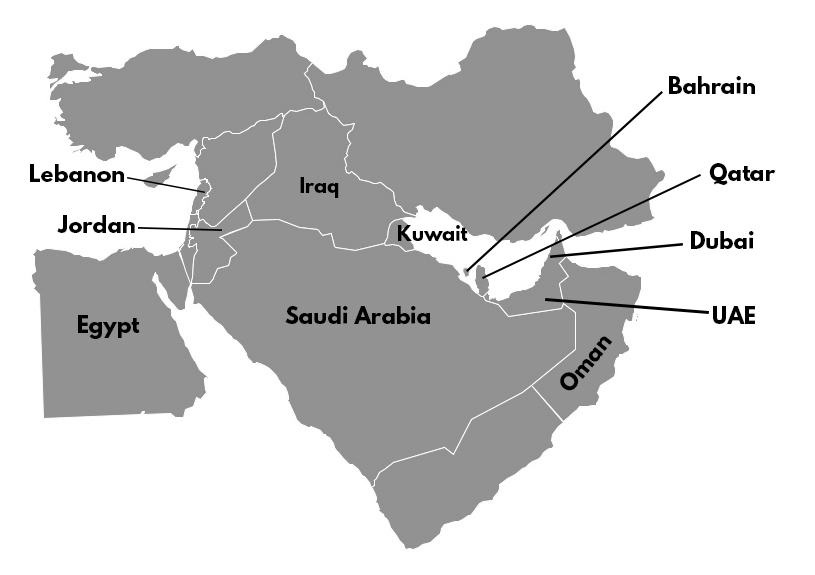

Middle East Online Marketing Country Profiles

Interested in doing online marketing in the Middle East? Check out the links below to profiles of countries you are interested in. We will be adding country profiles as we find the time and resources to create more. Feel free to reach out to us if you are interested in learning more.

Click on the Country you like to view.