In this guide, we will give an introduction to the world of the high net worth Arabs and ultra high net worth Arabs. We are concerned with how these individuals have achieved their great wealth, what types of projects, investments, and causes they spend their money on, and what type of foreign investments they are likely to hold or in which they are likely to take interest.

We will briefly analyze the spread of “HNW” (high net worth) Arabs throughout the Middle East (those holding liquid assets worth more than $1 million) and look at how their growth, methods of achieving wealth, and foreign investments differ from those of ultra-high net worth Arabs.. Throughout the article, we will make frequent reference to “UHNW Arabs” (ultra- high net worth Arabs) and “UHNWIs” (ultra-high net worth individuals). Ultra-high net worth individuals are defined as those who hold liquid assets exceeding $30 million. In this article, we will generally exclude from analysis those ultra-high net worth Arabs who hold wealth as government caretakers rather than as individuals – e.g., members of royal families. We will discuss the wealth and spread of UHNWIs in the Middle East, introduce some of the wealthiest individuals in the region, then delve into how they tend to spend their money and how this information could be of use to the marketer. Feel free to skip to sections that most interest you.

Where are the HNW and UNHW Arabs?

The 15 Richest Individuals in the Middle East

How did the UNHW and HNW Arabs achieve their millions?

How do high net worth Arabs spend their money?

How do the ultra-rich Arabs spend their money?

What foreign investments do HNWIs in the Middle East hold?

Foreign Investments Among the Ultra-Rich

What does this report mean for the marketer?

Where are the HNW and UHNW Arabs?

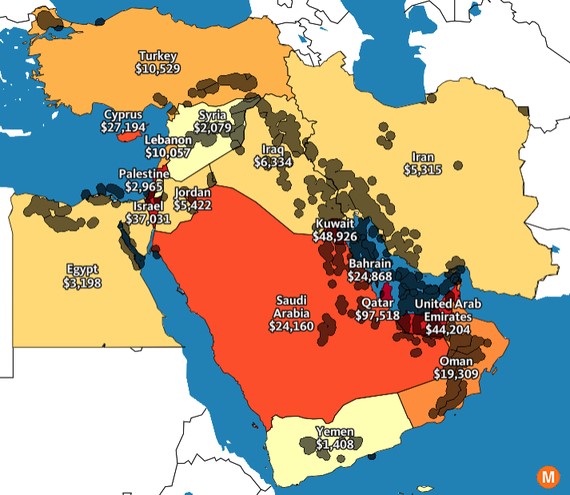

High net worth individuals in the Arab world are a rapidly growing and well spread-out proportion of the population. In Qatar alone, the total number of individuals classified as HNWIs has increased exponentially from only 9,500 in the year 2000 to 39,000 in 2015. The United Arab Emirates is the country with the highest number of HNWIs with 72,100 individuals crossing the million-dollar threshold. Saudi Arabia holds 59,000 similarly wealthy individuals. Over the 15-year period spanning 2000 and 2015, the growth rate of HNWI population in the Middle East was approximately 136%, compared to a world growth rate of 73%. Much of this growth is seen in countries such as Qatar, Iran, and the UAE. The slower growth in Saudi Arabia has been attributed to factors such as drops in oil prices. The strength of the UAE and Qatar has been cited as the strength of equity and real estate markets in those countries.

Across the entirety of the Middle East and North Africa region, nearly 6,000 individuals have crossed the $30 million threshold to be classified as UHNWIs. Nearly half of these individuals originate from either Saudi Arabia or the United Arab Emirates, with the rest spread out in Oman, Egypt, and other Arab nations. Saudi Arabia has the greatest number of UHNW individuals – approximately 1495 Saudis fall into this category with a net wealth of around $320 billion. The UHNWI wealth of Saudi Arabia is about 32% of the total wealth generated by these individuals in the Middle East ($995 billion). In contrast, the UAE holds about 1275 ultra high net worth individuals with a total wealth of about $225 billion. Of these 1275 people, around 1000 are based in either Abu Dhabi or Dubai.

Across the entirety of the Middle East and North Africa region, nearly 6,000 individuals have crossed the $30 million threshold to be classified as UHNWIs. Nearly half of these individuals originate from either Saudi Arabia or the United Arab Emirates, with the rest spread out in Oman, Egypt, and other Arab nations. Saudi Arabia has the greatest number of UHNW individuals – approximately 1495 Saudis fall into this category with a net wealth of around $320 billion. The UHNWI wealth of Saudi Arabia is about 32% of the total wealth generated by these individuals in the Middle East ($995 billion). In contrast, the UAE holds about 1275 ultra high net worth individuals with a total wealth of about $225 billion. Of these 1275 people, around 1000 are based in either Abu Dhabi or Dubai.

Of these 6,000 ultra wealthy individuals in the Middle East, only about 78 are billionaires – commanding a net worth of $209 billion (21% of the total wealth generated by MENA-based HNWIs). Six of these billionaires are female. Surprisingly, the country with the largest number of billionaires in the Middle East is not Saudi Arabia or the UAE, but Turkey – housing 24 of the 78 Arab billionaires. While a majority of these extremely wealthy individuals are located in Saudi Arabia and the UAE (about 55%), MENA billionaires are spread out across the Arab region in Turkey, Egypt, and Lebanon. However, a significant number of Arab countries lack billionaires – including Iran, Iraq, Jordan, Qatar, Bahrain, and Yemen. This analysis of the spread of billionaires across the Middle East does not include government leaders, royalty, or others who control fortunes for a nation rather than as individuals. For this reason, billionaires in these countries many have been excluded from this statistic.

The 15 Richest Individuals in the Middle East

Prince Alwaleed Bin Talal Al Saud

Prince Alwaleed Bin Talal Al Saud, a Saudi native and self-made billionaire, has held the title of the richest man in the Middle East for the past several years. His current total wealth (in February 2017) is estimated between $18.4 billion (Forbes) and $20.2 billion (Bloomberg).  Though he has been famously suspected in the past of exaggerating his net worth in amounts of several billion dollars in order to appear more successful, his place at the top of this list is unquestionable. The prince accumulated his billions through investing in real estate with a mere $30,000 loaned by his father and selling the land he bought to multinational corporations. He continues to build his wealth today through investments in real estate, holding stakes across the Middle East, Europe, and the United States through hotels such as the Four Seasons Hotels & Resorts, Movenpick Hotels & Resorts, Hotel George V (Paris), Savoy Hotel (London), and the Plaza (New York). In addition to these real estate holdings, he holds stakes in foreign companies such as Citigroup and News Corp (where he is the second largest shareholder). He is also the founder and owner of Kingdom Holding Company, which is a publically listed conglomerate and a highly successful diversified investment holding company.

Though he has been famously suspected in the past of exaggerating his net worth in amounts of several billion dollars in order to appear more successful, his place at the top of this list is unquestionable. The prince accumulated his billions through investing in real estate with a mere $30,000 loaned by his father and selling the land he bought to multinational corporations. He continues to build his wealth today through investments in real estate, holding stakes across the Middle East, Europe, and the United States through hotels such as the Four Seasons Hotels & Resorts, Movenpick Hotels & Resorts, Hotel George V (Paris), Savoy Hotel (London), and the Plaza (New York). In addition to these real estate holdings, he holds stakes in foreign companies such as Citigroup and News Corp (where he is the second largest shareholder). He is also the founder and owner of Kingdom Holding Company, which is a publically listed conglomerate and a highly successful diversified investment holding company.

In addition to these investments across the globe, Prince Alwaleed Bin Talal Al Saud is committed to spending his massive fortune on philanthropy. He has vowed in the past to donate $32 billion to various philanthropic organizations over the course of his life. This pledge was made in 2015, a time in which his personal wealth was estimated by Bloomberg to be around $30.5 billion.

The second wealthiest person in the Middle East, Mohammed Al Amoudi, also resides in Saudi Arabia. However, he is originally from Ethiopia and concentrates many of his foreign investments in his home country. Al Amoudi is the single biggest foreign investor in Ethiopia – holding stakes in gold, coffee, rice, and land. He is also Ethiopia’s greatest individual philanthropist, focusing on improving healthcare and education in the country. His current net worth is estimated between $8.2 billion (Forbes) and $8.9 billion (Bloomberg). He is a self-made billionaire who aggregated his wealth through construction investments and building complexes such as hospitals and university buildings. He created Midroc, a construction conglomerate, and was a major player in building Saudi Arabia’s underground oil storage system.

Outside of his investments in his home country of Ethniopia, Al Amoudi holds a number of foreign investments in various countries through purchases of oil refineries and fields. One of his largest investments is in Sweden, where he owns the largest fuel company in the country. He is a large exporter of coffee beans for Starbucks and tea leaves for Lipton.

Mohamed Al Jaber

Mohamed Al Jaber is another self-made billionaire from Saudi Arabia, who began amassing his fortune by building high-quality housing for Western expats and moved into buying hotels. His current net worth is estimated by Bloomberg at $8.7 billion. He currently manages over 50 properties throughout Europe and Egypt, and acts as the founder and chairman of London-based MBI International Holding Group. MBI is an international conglomerate that operates across Europe and the Middle East and holds an estimated $10 billion in assets. Al Jaber is also a philanthropist known for his work in promoting cross-cultural education and dialogue as well as democracy and transparency in the Middle East through the MBI Al Jaber Foundation.

Nassef Sawiris is Egypt’s richest man, with a current estimated fortune of $5.6 billion accumulated from his management of OCI – a fertilizer producer and construction business with multiple plants and building facilities. This company operates in 25 different countries across Europe, North America, and the MENA region. In 2014, he cited his largest focus as expanding and developing further into the U.S. market, where he had already completed approximately $3 billion in projects. He recently became the largest investor in Adidas, with a 6% share in the company. His philanthropic efforts are focused primarily on education – creating scholar programs for Egyptians to study in the United States and supporting job creation in Egypt.

Majid Al Futtaim

Majid Al Futtaim is an Emirati billionaire, with a fortune currently estimated at $5 billion by Forbes. Although most of this wealth comes from a family inheritance, he grew his fortune through real estate and retail investments. Al Futtaim is the founder of Majid Al Futtaim Holdings, which operates hotels, malls, and retail arenas in 12 different countries in the MENA region. These properties include 11 hotels and 48 Carrefour supermarkets. He has been looking to further invest in the hotel industry in coming years and hoping to expand within the Cairo market. He recently opened the Mall of Egypt in 2016. His philanthropy, the Majid Al Futtaim Charity Foundation, concentrates on healthcare and education initiatives.

Abdallah bin Ahmad Al Ghurair

Abdallah bin Ahmad al Ghurair is one of the richest men in the UAE, with a current estimated worth of $6.8 billion. One of the greatest sources of his wealth is Mashreqbank, which he founded in 1967. Mashreqbank is one of the leading banks in the United Arab Emirates, and Al Ghurair still sits as its CEO. The rest of his fortune lies in diversified investments through his company the Al Ghurair Group, which holds stakes in food, retail, and construction projects throughout the Middle East and Europe. Like most of the ultra high net worth individuals on this list, Abdallah bin Ahmad al Ghurair concentrates heavily on philanthropic efforts. Last year, he pledged a third of his fortune to education programs in Arab countries.

Abdallah bin Ahmad al Ghurair is one of the richest men in the UAE, with a current estimated worth of $6.8 billion. One of the greatest sources of his wealth is Mashreqbank, which he founded in 1967. Mashreqbank is one of the leading banks in the United Arab Emirates, and Al Ghurair still sits as its CEO. The rest of his fortune lies in diversified investments through his company the Al Ghurair Group, which holds stakes in food, retail, and construction projects throughout the Middle East and Europe. Like most of the ultra high net worth individuals on this list, Abdallah bin Ahmad al Ghurair concentrates heavily on philanthropic efforts. Last year, he pledged a third of his fortune to education programs in Arab countries.

Hussain Sajwani

The third richest billionaire in the United Arab Emirates, and the BLANKTH richest in the Middle East, Hussein Sajwani holds a current net worth estimated by Forbes to be about $3.7 billion. He started accumulating his wealth in food service, but is best known for founding Damac Properties. Damac Properties is a construction firm, which he began in an effort to take advantage of a 2002 decree issued by the Dubai government that allowed foreigners to purchase land and property within the emirate. Damac Properties made revenues of $2.3 billion in 2015 alone and has built over 15,500 apartments since 2002. With his 72% stake in the company, Sajwani has quickly accumulated wealth over the past years. However, due to the current political climate that deters tourists from the Middle East and a tough low in the economy due to drops in oil prices, he predicts slower years in the future for high-end real estate in Dubai. Most projects and investments undertaken by Sajwani are concentrated in the Middle East and London.

Prince Sultan bin Mohammed bin Saud al Kabeer

Prince Sultan bin Mohammed bin Saud al Kabeer

Prince Sultan bin Mohammad bin Saud al Kabeer is a self-made Saudi Arabian billionaire who acquired his wealth through investments in dairy farms. He is the founder of Saudi dairy company Almarai, which trades milk throughout various Arab countries. He has retained a 28.6% stake in the company, which went public in 2005. He also holds stakes in multiple Saudi insurance firms and cement corporations. He currently serves as a managing director at Yamama Cement Company and as a chairman at Khalijia Invest and Arabian Shield Cooperative Insurance Company. His current net worth is valued at about $3.8 billion.

Murat Ulker

Murat Ulker is a Turkish billionaire who has been quickly accumulating wealth over the past few years. Through his investments in food manufacturing, he holds a current net worth of .7 billion – up from $2.9 billion just last year. Ulker is the chairman of Yildiz Holding, the largest food company in Turkey. This firm contains international brands such as Godiva, Ulker Biscuits, and United Biscuits.

Mohamed Mansour

Mohamed Mansour is an Egyptian billionaire, who currently enjoys a fortune of $2.7 billion procured through investments within Egypt, Russia, the United States, and various African countries. He is the owner and founder of Mansour Group, a conglomerate that has exclusive distribution rights for GM vehicles, Caterpillar products, Marlboro, and Chevrolet in Egypt. Most of the company’s revenue comes from outside sales of Caterpillar equipment in Russia and six African countries. It also holds international equity investments in the U.A.E., the U.S., and Africa. In addition, Mansour holds stakes in nine of Egypt’s Fortune 500 companies.

Sarik Tara

Sarik Tara is the owner of Enka Construction, the company that is now the biggest electricity provider and largest construction conglomerate in Turkey. Much of Tara’s investments are in construction and real estate, and most are concentrated in Turkey and Russia. He owns 63 supermarkets as well as various offices and shopping malls across Russia, and has built U.S. embassies in multiple countries – including those in the Dominican Republic and Afghanistan. His wealth has dropped sharply in recent years. His fortune is currently estimated at $2.4 billion, down from .3 billion in 2004. He uses this fortune to support education (through creating grants and scholarships and running clubs) and the environment (promoting reforestation and preservation of natural habitats) in Turkey, primarily through the ENKA Foundation. His foundation spends an estimated $2 million each year on this work, and Tara has received many awards for his philanthropic efforts.

Sarik Tara is the owner of Enka Construction, the company that is now the biggest electricity provider and largest construction conglomerate in Turkey. Much of Tara’s investments are in construction and real estate, and most are concentrated in Turkey and Russia. He owns 63 supermarkets as well as various offices and shopping malls across Russia, and has built U.S. embassies in multiple countries – including those in the Dominican Republic and Afghanistan. His wealth has dropped sharply in recent years. His fortune is currently estimated at $2.4 billion, down from .3 billion in 2004. He uses this fortune to support education (through creating grants and scholarships and running clubs) and the environment (promoting reforestation and preservation of natural habitats) in Turkey, primarily through the ENKA Foundation. His foundation spends an estimated $2 million each year on this work, and Tara has received many awards for his philanthropic efforts.

Mohammed al Issa

Mohammed al Issa is a Saudi billionaire with a fortune of .1 billion in 2004 through various investments. Al Issa is the president of both Qatrana Cement Company and A.M. Al-Issa Consulting Engineers, and the owner of a business for engineering consultancy. He also owns stakes in large Saudi food processors and Dur Hospitality, currently valued at $2.6 billion. He is considered one of the largest individual investors in Saudi Arabia.

Najib and Taha Mikati

Najib and Taha Mikati are brothers, and owners of the largest fortunes in Lebanon due to their extremely successful telecom business. As of 2014, both brothers (individually) were worth an estimated .1 billion. Investcom, their telecom business, owned a number of international companies and had expanded throughout Africa but was bought out by the MTN group in South Africa in 2006. Even today, the most valuable asset held by the brothers is their nearly 10% share in MTN stock obtained through this deal. Since the sale of Investcom, Najib Mikati has formed an M1 group to coordinate interests in telecom, real estate, and retail. He became Prime Minister of Lebanon in 2011, but resigned in 2013.

Hüsnü Özyeğin

Hüsnü Özyeğin is the second richest man in Turkey, with a personal fortune estimated at billion by Forbes in 2014. He is a self-made billionaire who got his start working as the general manager of a friend’s bank and gradually moved to owning his own. He is the founder of Finansbank, a successful Turkish bank with a large number of foreign branches and investments which was sold to the National Bank of Greece in 2006. Currently, Özyeğin owns Fiba and Fina Holding – a company that makes investments in real estate, ships and ports, and energy both in Turkey and abroad. His holdings include Fibabanka and Marks and Spencer in Turkey, Ukraine, and Russia. He founded Ozyegin University in Istanbul and focuses most of his philanthropic work on promoting education, especially for young women. He claims to have given over $400 million to charitable causes.

How did the UHNW and HNW Arabs achieve their millions?

Most of the individuals we introduced on the list of wealthiest Arabs amassed their wealth personally through entrepreneurship and savvy investments in real estate, banks, and the construction industry. This trend is common throughout the Middle East – around 57% of UHNW Arabs created their own fortunes through entrepreneurship and similar investment ventures. Only 8% of UNHW Arabs received their fortunes fully through inheritance – the rest grew their inheritances into larger fortunes. The amount of UNHW Arabs who grew wealth from an initial inheritance is relatively high, likely due to the fact that around 1/3 of ultra-rich individuals in the Middle East are related to each other and pass down their family wealth. A recent study by the Boston Consulting Group showed that the growth rate of wealth and number of UHNW households is growing at an unprecedented rate in the GCC, particularly in Qatar, Kuwait, and the UAE. The BCG speculated that this was due to strong petroleum prices. It is a common belief that the ultra-wealthy in the Middle East are rich due to the region’s abundance of petroleum and other natural resources. However, we can see from this list that investment in real estate is a much more common method to amassing wealth in the Middle East and that few of the wealthiest Arabs (again, excluding members of royal families and governments) are rich due to petroleum. For example, only 3% of the UHNW population in the United Arab Emirates made their wealth through the oil and gas industry. This is a surprisingly low number, considering that the U.A.E. has the 7th greatest amount of oil reserves in the world, and 5th greatest in the Middle East.

However, these oil reserves are regularly cited as the main source of revenue for the region’s HNW population. While oil prices were trading at a high from 2011 to 2015, the HNW population grew by nearly 8.1%. Over the next few years, this population is expected to further increase at a slower rate due to the recent drops in oil prices. Qatar and Bahrain are expected to see the most growth in their millionaire populations due to the ongoing development of these markets. Private wealth continues to grow in the UAE and in Saudi Arabia – along with the population and holdings of high net worth individuals – due to these high oil prices, a government- sponsored diversification of the economy, and a global rebound in equities.

Map of the oil spread and country GDP across the Middle East

How do high net worth Arabs spend their money?

Although a majority of HNWIs in the Middle East have created their wealth through investments, studies have demonstrated a general caution around investment and a preference for local purchases among Arabs. These individuals tend to keep a great deal of their portfolios in cash, and concentrate on building trust before structuring investments in a company or bank. This caution and the desire to see where their money is being spent drives most Arabs to concentrate their investments within the Middle East – 64% of HNWIs in the area have agreed that they feel as though they have more control over their investments when those investments are located closer to home. However, another important factor is that these individuals generally have more confidence in their local markets – feeling as though they are more stable than the global economy and would give greater returns than foreign investments.

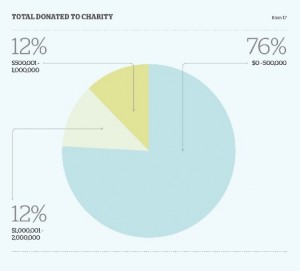

Outside of investments and capital accumulation, HNWIs in the Middle East have interesting spending patterns and preferences. A survey run by Bayt.com revealed that 68% of Arab HNWIs regularly buy online, compared to 58% of Arab individuals in general. The top purchases made by these individuals were in travel reservations and software. Surveys focused on the philanthropic efforts of HNWIs also reveal important information about their spending habits. According to the Arab Giving Survey, the average HNWI is more likely to give to a charity and likely to donate more when the charity’s business is more transparent. However, it also found that around two-third of wealthy Arabs do not plan these expenditures. The survey discovered that only 6% of wealthy Arabs use a strategy to guide their charitable donations, and no respondents employed staff to oversee their giving. Favorite causes for wealthy Arab donors focus on poverty alleviation, refugee assistance, and education. A majority of these individuals estimated that they had donated up to $500,000 to charity in one year.

Outside of investments and capital accumulation, HNWIs in the Middle East have interesting spending patterns and preferences. A survey run by Bayt.com revealed that 68% of Arab HNWIs regularly buy online, compared to 58% of Arab individuals in general. The top purchases made by these individuals were in travel reservations and software. Surveys focused on the philanthropic efforts of HNWIs also reveal important information about their spending habits. According to the Arab Giving Survey, the average HNWI is more likely to give to a charity and likely to donate more when the charity’s business is more transparent. However, it also found that around two-third of wealthy Arabs do not plan these expenditures. The survey discovered that only 6% of wealthy Arabs use a strategy to guide their charitable donations, and no respondents employed staff to oversee their giving. Favorite causes for wealthy Arab donors focus on poverty alleviation, refugee assistance, and education. A majority of these individuals estimated that they had donated up to $500,000 to charity in one year.

How do the ultra-rich Arabs spend their money?

Ultra-rich Arabs tend to focus their spending on two areas: further investments (most often in real estate) and philanthropic expenditures. In both areas, they generally prefer to spend their money closer to home. The reasons for this preference have generally been cited as caution around investment and greater confidence in the local economy. A recent study by the Boston Consulting Group has suggested that UNHW investors in the Middle East, as compared to similarly wealthy investors in other parts of the world, typically hold much lower appetites for risk. Surprisingly, the average UNHW Arab investor holds around 56% of total assets in cash due to caution around investing. In 2014, the Middle East Investment Conference predicted that in coming years, Arab UHNWIs would further restrict their wealth accumulation efforts to investments in their own businesses and in local (Middle East-based) real estate. In that year, approximately 28% of ultra-rich individuals in the GCC claimed an interest in focusing future investments in the U.A.E. The favorite sectors for UHNW Arabs have historically been manufacturing, healthcare, education, and oil and gas. The most popular asset class among this group has been real estate, despite the suffering of the sector in the past few years. The ultra-wealthy tend to invest around 35% in their own companies compared to about 25% in real estate.

Ultra-rich Arabs tend to focus their spending on two areas: further investments (most often in real estate) and philanthropic expenditures. In both areas, they generally prefer to spend their money closer to home. The reasons for this preference have generally been cited as caution around investment and greater confidence in the local economy. A recent study by the Boston Consulting Group has suggested that UNHW investors in the Middle East, as compared to similarly wealthy investors in other parts of the world, typically hold much lower appetites for risk. Surprisingly, the average UNHW Arab investor holds around 56% of total assets in cash due to caution around investing. In 2014, the Middle East Investment Conference predicted that in coming years, Arab UHNWIs would further restrict their wealth accumulation efforts to investments in their own businesses and in local (Middle East-based) real estate. In that year, approximately 28% of ultra-rich individuals in the GCC claimed an interest in focusing future investments in the U.A.E. The favorite sectors for UHNW Arabs have historically been manufacturing, healthcare, education, and oil and gas. The most popular asset class among this group has been real estate, despite the suffering of the sector in the past few years. The ultra-wealthy tend to invest around 35% in their own companies compared to about 25% in real estate.

One of the greatest expenditures outside of investment for UNHW Arabs is philanthropic efforts. Most of the ultra-wealthy Arabs discussed in this article have made public pledges to donate the majority of their wealth to charity, and the majority of the ultra-rich have donated millions to various causes. Among the individuals on this list, the most common philanthropic expenditures have been focused on education and healthcare, focused within their home countries and within the Middle East region in general. A 2016 article cited UNHW Arabs as the most generous among the world ultra-rich community, tending to give around 10% of their wealth to charity (outside of anonymous zakat donations). The median gift to a charity made by UNHW Arabs is about $5 million – twice as much as the average UHNWI in North America.

What foreign investments do HNWIs in the Middle East hold?

Although many HNWIs in the Middle East hold foreign investments – typically in Western Europe, the United States, and African countries – they generally prefer to restrict these investments in favor of the local market. According to a report by the Middle East Investment Conference, ultra-rich individuals in the GCC prefer international banks only 36% of the time, claiming that local banks are more secure and have a better understanding of the regional market. This is not to say that they are not highly interested in foreign investments. Although a small percentage of Middle East-based HNWIs prefer to concentrate on local investments as a form of risk mitigation and capital preservation, around 90% of these individuals focus primarily on capital appreciation and are open to exploring foreign investments. In 2014, ultra-high net worth individuals were reported to have their eyes on foreign investments in China, the European Union, India, the United States, Australia, and Canada for the next few years. They claimed that investing in these countries offered great opportunities of capital appreciation.

Due to the recent global economic downturn, approximately 25% of Middle East-based HNWIs have restricted their global investments in favor of capital preservation and more stable and controlled investments in their home regions. While these HNWIs have historically been interested in – if cautious about – foreign investments, their activity in the global market has the potential to decrease significantly in coming years.

Foreign Investments among the Ultra Rich

Both high net worth and ultra-high net worth individuals in the Middle East concentrate heavily on growing their portfolios through savvy investments – both groups investing an average of 8% in private equity and direct investments, 6% in precious metals, and 6% in more traditional stocks. However, in recent years, the greatest chunk of a portfolio, especially for UHNWIs, has been real estate. Ultra-wealthy put 25% of their portfolios in real estate and have indicated that around 37% of additional income would be spent to secure more property.

Prince Alwaleed bin Talal al Saud, the richest individual in the MENA region for a number of years, holds $3 billion worth of investments and projects outside of the Middle East – compared to only $875 million worth of stakes in Middle Eastern companies. One of the greatest stakes in this figure is the enormous amount of Twitter stock he holds – 30.1 shares in which he invested personally and an additional 4.8 million through his investment conglomerate Kingdom Holding.

Nassef Sawiris, an Egyptian billionaire, is another large investor in the United States – completing an estimated $3 billion worth of projects in the U.S. alone and establishing himself as the largest methanol producer in the country. He claims high interest in being an active player in the U.S. market and sees great potential for return on investment there. However, he also cites difficulties in completing U.S. projects – including rigorous approval processes and higher labor costs as compared to the Middle East. He is expected to turn more to his local Egyptian market in coming years, as he predicts greater development and investment opportunity closer to home.

Nassef Sawiris, an Egyptian billionaire, is another large investor in the United States – completing an estimated $3 billion worth of projects in the U.S. alone and establishing himself as the largest methanol producer in the country. He claims high interest in being an active player in the U.S. market and sees great potential for return on investment there. However, he also cites difficulties in completing U.S. projects – including rigorous approval processes and higher labor costs as compared to the Middle East. He is expected to turn more to his local Egyptian market in coming years, as he predicts greater development and investment opportunity closer to home.

Nasseff Sawiris’s turn to the local market reflects a greater trend among Middle Eastern ultra-rich individuals.

What does this report mean for the marketer?

A savvy marketer hoping to take insight from ultra-wealthy Arabs and increase the growth of his or her own business should focus on the preference shown by the UNHW Arabs for their local markets, the favorite sectors for investment, and the indicators given by these individuals about future growth in the Middle East. Many UHNW individuals in the Middle East have indicated a greater interest in investing in projects within their area both because they feel as though the local economy is stronger than the global economy and because they feel as though they hold greater control over their investments when they are in closer proximity. Marketers can use this information to establish bases in the Middle East and close ties with local banks so that Arab investors feel more comfortable that marketers are in touch with the Middle Eastern market and that they have a greater sense of knowledge and control over their investments.

Another important insight to be gained from this report is the focus exhibited by ultra-wealthy investors toward construction projects and real estate investments within the Middle East – particularly in Cairo and the United Arab Emirates. The growth and interest of these sectors indicate that UHNW Arabs predict an uptick in tourism and a strengthening of the economy in future years. The concentration on building and investing in properties such as hotels, malls, and retail outlets predicts an upcoming touristic and economic boom for the Middle East. Marketers can use this information to inform where and how they market in the area, and how much to invest in attracting the MENA market.

Conclusion

The advice and example of ultra-rich Arabs discussed here offer great hope to marketers looking to expand generally into the MENA market. The region’s savviest investors see their local economy growing and strengthening in coming years, and are predicting an influx of tourism into Cairo and the U.A.E. The focus on building real estate through shopping malls, retail locations, and hotels indicates a future boom not just in travel, but in the economy as a whole. UNHW Arabs are predicting that the best returns on investment will be achieved through development of the Middle East and broadening choices for Arabs. By establishing footholds in the Middle East and cultivating ties with local Arab banks and businesses, marketers can gain trust and potentially see great return on investment by jumping into a currently open and rapidly strengthening market.

Originally written by : Megan Gregory

Updated by

Jordan Boshers

Jordan Boshers is the Chief Digital Strategist at IstiZada, a digital agency that helps companies market to Arabs. He has 12+ years of experience running successful digital marketing campaigns in the Arab world. His insights into Arabic SEO helped him grow previously unknown websites to dominate Arabic niches on Google including growing one site from 0 to more than 2.5 million users monthly. Jordan has consulted for hundreds of companies including helping corporations like Amazon, Berlitz, and Exxon Mobil with their Arabic digital marketing. Learn more here or on LinkedIn.

View all posts by Jordan Boshers