Dubai SEO – The Complete Guide – 2024 Update

The United Arab Emirates is the e-commerce leader of the Gulf Region and ranked 6th highest in the world for GDP per capita. If you’re looking to take advantage of the business opportunities by increasing your visibility in search engines in the UAE’s business hub of Dubai then this Dubai SEO guide is for you. Though there are many similarities in how SEO is done in different cities around the world this guide gets into detail about a variety of aspects of SEO in Dubai that may be helpful both for do-it-yourself marketers and those looking to get an idea of the competitive landscape of online search in this city.

SEO Awareness

The relative awareness of SEO in Dubai in 2024 is high compared to most cities in the Middle East. This is due to several factors. There is a large Indian tech presence in Dubai, and given the popularity of SEO in India this has raised the awareness of SEO in the region. Dubai is also a tech hub in the region and even has areas of the city that are entirely focused on the Internet. Despite the awareness of SEO, there is a great deal of misunderstanding about best practices and the difference between black hat and white hat (Google approved) SEO.

Factors to consider before you try to rank in Dubai

Before we start talking about how to rank well in search engines in Dubai. We want to talk about whether it’s worthwhile to try to rank in Dubai. Here are some of the factors you should be looking at before you decide if it’s worthwhile to optimize your site to rank well in Dubai.

- You have a significant audience for your product or services in Dubai

- Your audience in Dubai is big enough to warrant an investment in SEO

- You have the ability to sell your products or services in Dubai

- You either have a presence in Dubai, or you can get your products or services to Dubai

- You’re committed to the long-term investment of SEO. Good SEO results take time and won’t happen overnight.

Search Engines in Dubai

Google is the dominant search engine in Dubai with over 95% of the total market share. Yahoo and Bing make up about 3% of the total search market so Dubai marketers should focus on optimization for Google first and then, if it makes sense, optimize for Yahoo and Bing. With Bing’s integration of ChatGPT in 2023 we may see Bing’s market share grow over the next few years.

Search Language

As a multilingual city, Google understands that it’s important to offer its search engine in multiple languages in Dubai.

Arabic

Considering the fact that Dubai is a hub for the Middle East and controlled by a great Arab population, Arabic is obviously a key language for search. Though Emiratis only make up about 25% of the population there are also many other Arab individuals and families from other Arab nations that live in Dubai. In addition to this, hundreds of thousands of Arabs come to Dubai each year on vacation from surrounding nations like Saudi Arabia, Qatar, Oman, Bahrain, and Kuwait. Arabic is the native language of all of these people so for marketers to be truly effective in Dubai they must learn to be good at Arabic SEO.

English

Given the fact that Dubai is a multicultural city, English is probably the most widely spoken language within the city limits. English is a trade language that allows people from all the different nations that reside in Dubai to communicate with each other effectively. English is also one of the official languages of Dubai and most of the advertising within the emirate. In fact, Google.com ranks even higher than Google.ae in Dubai, which highlights the influence English has. If you’re considering targeting any of the expatriates that live in Dubai, English is probably your first choice in regards to your SEO efforts. In addition to this, English is also the most widely used language among tourists to the country of Dubai. So if you’re considering targeting tourists that come to Dubai, you need to use English.

Hindi

Despite the fact that Dubai is an Arab city, the largest ethnic population in Dubai is actually from India: over 38% of the total UAE population are Indian nationals. This makes it so if you want to effectively target the nation’s largest expat population you should consider optimizing your website in Hindi in addition to English. With that said, depending on the type of product or service, offering Hindi may not be worth your time and effort. This is because many upper-class Indians speak English well and tend to do business mostly in English. On the other hand, those who tend to use the internet in Hindi may oftentimes be less likely to be affluent or from the upper-middle-class. Many of the individuals who are using the internet predominantly in Hindi are most likely migrant workers working in low-paying jobs like construction or other manual labor positions. Despite this, if you really want to take advantage of all the opportunities Dubai has to offer in regards to marketing your products and services online, you should consider targeting Hindi speakers because they make up such a large portion of the population and have a lot of purchasing power as a group.

Farsi

Dubai is just across the Gulf from Iran. Due to the proximity to this Farsi-speaking country, there are many Persians that live in Dubai. To add to this Persians were very influential in the building of what has now become modern Dubai. Many Persians play key roles in businesses all across Dubai in the United Arab Emirates. Due to this fact they are still very influential in the business community in Dubai. Though many of these Persians are used to doing business in English and sometimes in Arabic, Farsi is their native language so optimizing for the Farsi language may be worthwhile if you’re looking to reach this segment.

Urdu

Urdu, similar to Hindi, is the language of many Indian and Pakistani residents of Dubai. As a language, there are far fewer individuals that speak this language than Hindi but it is still an important language for many of the reasons we mentioned for Hindi. With this said if you plan to market to Urdu speakers in Dubai consider that most speakers of Urdu are Muslims so your messaging may be different in some cases.

The basics of getting your site to rank in Google in Dubai?

1. Keyword research

Just like in any other market your keyword research is the foundation for your SEO efforts. Using tools like the Google keyword planner and other paid tools, it’s important to figure out how your potential customers are searching for your products and services in Dubai. It’s important not to make the assumption that you will target the same keywords that you target in other cities and countries around the world because each market is unique. Since Dubai is a multi-ethnic city you may find that there is a large variety of ways that potential customers search for your products and services. Due to this many businesses find that it can work well to target a wide variety of keywords related to your industry in order to capture traffic from various different demographics in Dubai.

A great deal of time and effort should be put into the keyword research because if it is done correctly your SEO efforts will go much smoother and produce much greater results than if it is done poorly and you select the wrong keywords. If you are targeting local keywords you may want to consider adding keyword modifiers to some of your industry keywords to see how people search for them locally. This might include things like “restaurants in Dubai” or “Dubai dentist”.

Once you’ve determined which keywords are the best fit for your website then you must determine how to target those keywords on various pages of your website.

2. Assigning keywords to the proper pages

Having your keyword research complete, you must take your list of keywords and determine which keywords to focus on, on specific pages of your website. You may already have some existing pages on your site that you can assign a group of 3 to 5 similar keywords to, or you may need to create new pages for certain keywords that the keyword research revealed.

3. Use your target keywords in the title, URL, and Meta description

Use the keywords you assigned to each page within the title, URL, and Meta description of the page. Since you’re targeting Dubai, it might be a good idea to include the city name along with other keywords in the title of the page. If you’re targeting a specific part of Dubai, it may be worth incorporating that into your title too.

4. Content

Content is extremely important to getting SEO results. Google can have a hard time indexing your website for relevant keywords and variations of those keywords if they do not exist within the content of your site. Search engines typically can’t see the content that’s within image, video, and various design elements of the page, so in light of this, they rely heavily on the text content of the website to be able to determine how relevant it is to a specific subject area or search query.

We are by no means saying to excessively use your target keywords in your content. Modern search engines are very savvy so often times using a keyword just a couple of times is enough. With that said, the use of synonyms and words related to your target keywords can help to make it overly clear to Google what your pages and your website are all about. As a general rule, it’s good to look at other websites in your industry and aim for having about 20% more content on your pages than they have.

Don’t forget that you’re not just writing content for the sake of writing content but visitors to your website will also read this content. In light of this fact, try to make this content engaging, interesting, and worthy of your visitor’s time. You should seek to add value to the website visitor through your content and include important features and benefits of your services and/or products in the content. If your goal is to try to get the visitor to make some sort of important action on a page like a sale or a sign up, remember to include calls to action to drive the visitor towards your desired goal. You could also use consider using certain interactive features such as quizzes or searchable maps on your site, which is another way to help make your site stand out against the competition.

5. Local Dubai links

Getting links from local websites is a signal that your website is also relevant to Dubai. In many industries, if you have a presence in Dubai it’s actually not that hard to find opportunities to get links from other websites in the city. Here are some great examples of the kind of links to look for.

- Local Business Clubs For Your Industry

- Dubai Event Sites

- Local Niche Directories

- Dubai Resource Pages

- Community Pages

- Partner Sites

- Vendor Websites

- Local Contests That Have Websites

- Dubai Job Postings

- And More

6. User experience for Dubai visitors

This is probably the most neglected area of SEO that can have a very significant impact on how well your website ranks. Many websites find that they do everything right and they are able to climb the ranks to the first position for their target keywords in Google, but within a short time, they find that their rankings start dropping again. This oftentimes has to do with the user experience on the page. Even if all the other SEO factors are great, if this one factor is bad it can ruin your ability to rank in a top position. In essence, this means that when visitors come to your website and they don’t find what they’re looking for they quickly bounce off the site and return to the search results. This signals to Google that your website isn’t relevant for that search query and if this happens enough Google will start to put other websites above yours in the search engine results.

So it’s important to think about your design, the user experience on your website, and how professional your website looks to potential customers from Dubai in addition to other more technical SEO elements.

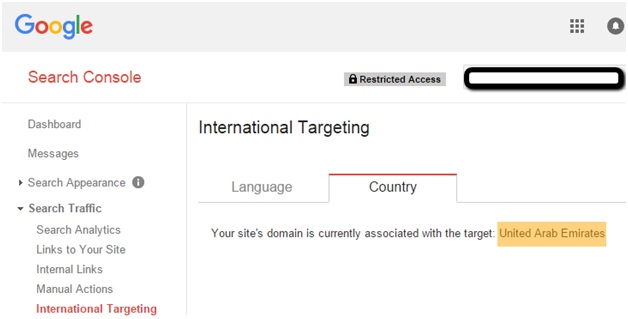

International Targeting for Dubai

We’ve found that in general since Dubai is a hub for Gulf business many websites in the region set up with a .ae domain. Though this signals to Google that the website is just for the target audience of people that live in the Emirates it also may be perceived as relevant to the rest of the GCC as well because Dubai is perceived as the hub for GCC businesses. If you do choose to have a .ae domain name and still want to target GCC countries you should also make sure to either change your Google Webmaster Tools location setting to “unlisted” or use the hreflang tag to accomplish this.

How important is it to have a .ae domain?

We looked at 10 competitive search queries in Dubai and counted the number of .ae websites that showed up on the first page of Google results for those search queries. In about half the cases there were zero .ae websites ranking on the first page of Google. In the rest of the cases, there were one or maybe two .ae websites in the top 10. In only one case did we find that there were a total of four .ae websites ranking on the first page of Google.

The above information appears to indicate that having a .ae domain is not extremely important to be able to rank well for most keywords. With that said it has been shown in many cases that country code top-level domains like .ae have been shown to give a website a little bit of an advantage, all other factors being equal, to be able to rank well in Google in that country. It may be that because of the relative recency of this domain extension that very few companies have invested in it. But this may change over time.

Something that may be of additional interest is the fact that we found that in many cases there were more .ae domains showing up in Google’s paid search results for most search queries than there were in the organic search results. This might have to do with the fact that paid advertisers tend to be more internet savvy than many websites that show up in the organic search naturally.

Another interesting note is that when Amazon entered the Middle East market and bought Souq.com they decided to go with Amazon.ae as their main domain for the UAE even though Souq.com did not use a .ae domain. Amazon took the same approach with a country-specific domain in Saudi when they launched Amazon.sa in June of 2020.

IstiZada’s recommendation: if your main focus is Dubai and you’re very motivated to rank quickly we do recommend purchasing a .ae domain. However, if you already have a website or your main focus is not Dubai, or the UAE for that matter, it’s probably not worth the effort at this time to purchase and use a .ae domain.

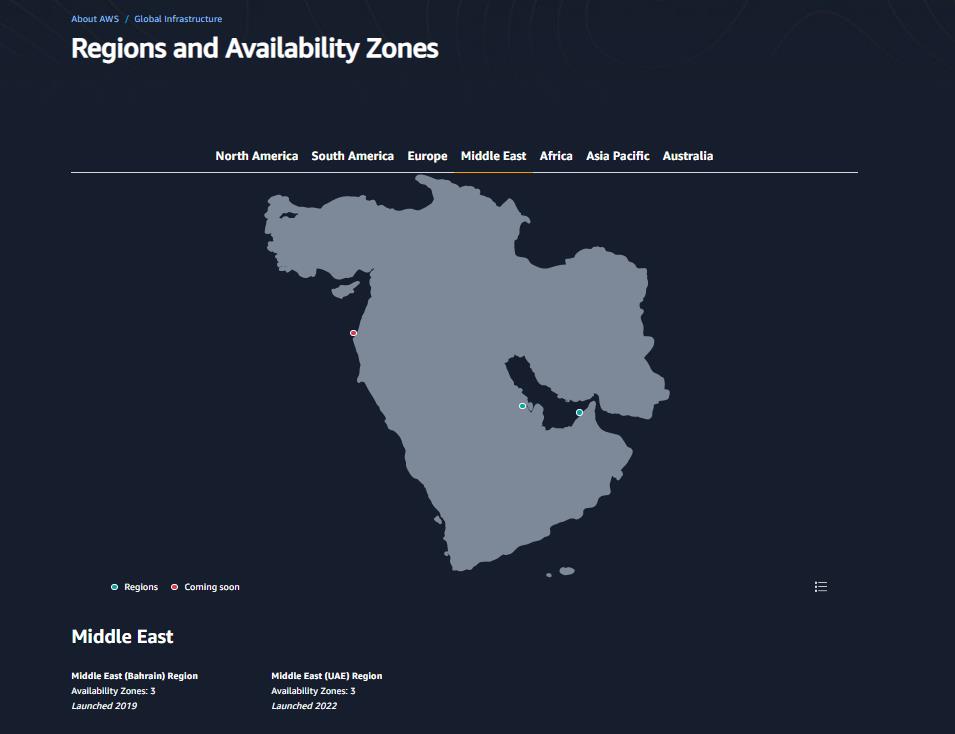

Local Dubai Website Hosting

Local website hosting is available in Dubai from several different providers. It’s actually one of the few cities in the region with reliable locally located servers. In theory, this should help improve local and regional rankings for websites that host on local servers, but given that it is more common to host websites on servers in other countries around the world we don’t have any conclusive data to prove this is correct for Dubai. If you are thinking of hosting locally both for SEO and to improve page load speeds we strongly recommend you make sure your hosting provider actually has servers in the UAE and is not just a reseller of hosting services with servers outside the country. Amazon Web Services, AWS, launched local hosting in Dubai in 2022 and pricing scales to meet the needs of all sizes of websites.

Google Maps optimization

Google maps optimization is another term for local SEO. Companies in Dubai that have a physical location can benefit from this type of optimization. Maps optimization centers on a few key factors.

- Having a local business with a Google Business Profile page

- Consistent Business Name, Address, and Phone number across the sites your business is listed on

- Getting genuine reviews on Google and over review sites

- Getting some links from other high-quality Dubai websites

- Including important local keywords with your local listings and web pages

Of course, there are other things that can help with local rankings but the five above are probably the most important and we don’t have space here to get very in-depth into this area.

Ways to Appear Local when you don’t Have a local presence in 2023

If you have an international company but you want to be able to rank better in Google’s local search results in Dubai you can target local keywords on some of the pages of your website, or have a section of your website that’s devoted to just Dubai. Google is going to be looking for the most locally relevant results in your industry, but will also look at things like the authority and the relevance of your website to the industry topic you are targeting. In light of this if you can provide extremely relevant informative and valuable content that is related to a topic that concerns Dubai you could also rank for this keyword. For example, the keyword “Dubai Investments” might be a word you want to rank for, but you don’t actually have an office in Dubai. However, you do offer Dubai-related investments. You could write an in-depth guide to the best investment opportunities in Dubai, and if it’s also valuable to your target audience you could find that you end up ranking for the keyword “Dubai investments”.

Another option for businesses that want to appear in search engines in Dubai in the local search results is getting an address in Dubai. Many companies that are just getting started in Dubai use services like Regus or SERVCORP to get a local virtual office in Dubai even though their presence is elsewhere.

Next we get into some examples of organic local search results from the view of someone located in Dubai.

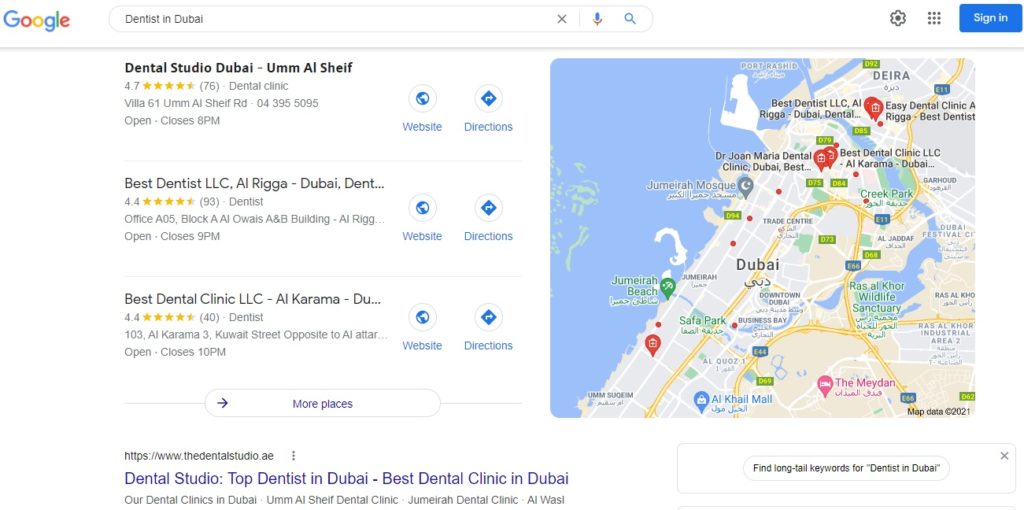

Local SEO in Dubai – Dentists, Lawyers, Restaurants, Hotels

Below we will evaluate some of the local SEO results in Dubai for both Arabic and English.

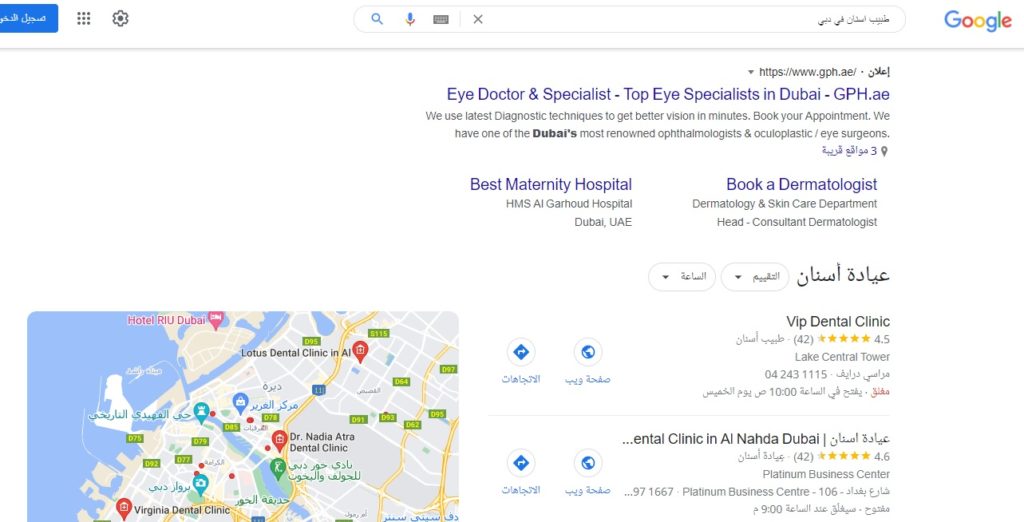

Let’s start with the competitive field of dentistry. In the example below we search for the keyword “Dentist in Dubai”, most likely the top keyword for this industry in Dubai.

In the results above we see Google displays a 3-pack of local results. Surprisingly all three results have a significant enough number of quality reviews to get stars to appear next to them. It’s also worth noting that businesses that chose not to compete in regards to SEO rankings will face stiff competition in English for paid ad positions on this results page. All the ad spots are filled on the first page of Google so this keyword is a very competitive term for PPC.

In Arabic the results are very different…

Surprisingly, Arabic results now contain the standard 3-pack of local results like we see above. But when we looked at the map results we found there were very few optimized business pages in Arabic. This seems like a big opportunity for businesses that can provide services for Arabic speakers. Saudi Arabia alone has 1 million tourists come to Dubai each year. Many of these Saudi tourists travel to Dubai for its shopping and less strict laws. This is not to mention all the local Arabs that live in Dubai.

Restaurants

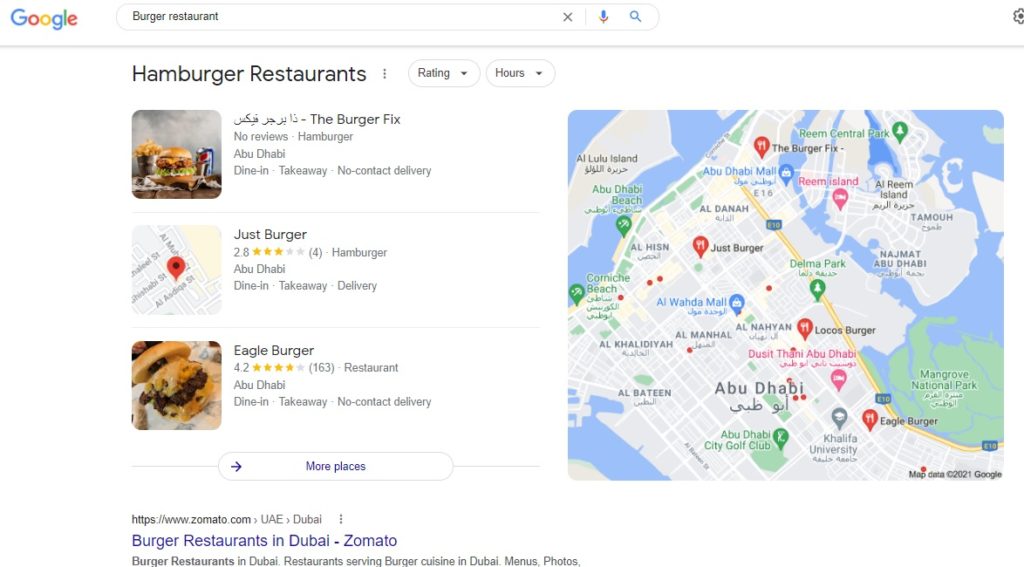

We also did a search for “Burger restaurant” in Dubai. Below is a snapshot of what we saw in English.

Again we see a 3-pack of local search results but in a slightly different format. There is one big map on the right side for directions. The rest of the results that show up below this box are normal website search results. most restaurants listed here have relatively few reviews as well and the listings don’t seem very well optimized for Google search.

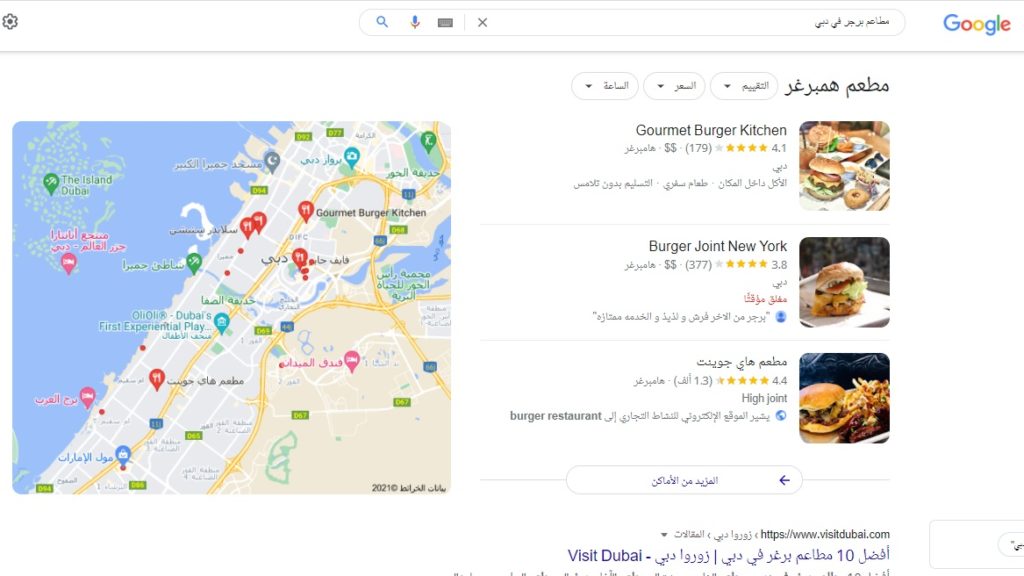

The Arabic search results for the same search query were again quite different. See our snapshot of the Dubai search results below.

In this case, we see the standard 3-pack with surprisingly more reviews than the English ones, and it is mostly ordering websites, listing sites, and review sites that occupy the top positions on the page. Again we see a case where Arabic local search results in Dubai are much less competitive than the English results are.

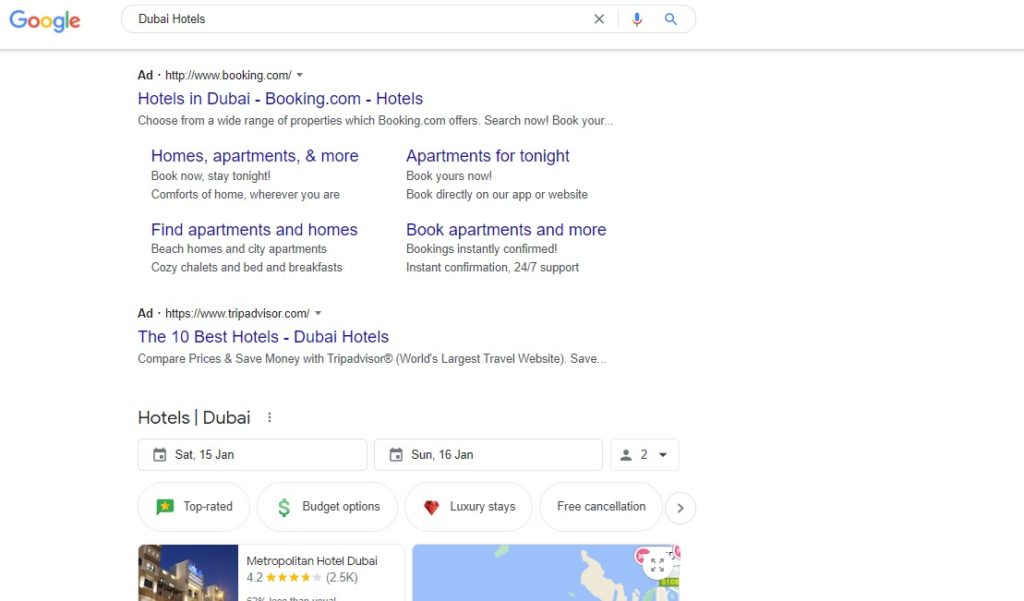

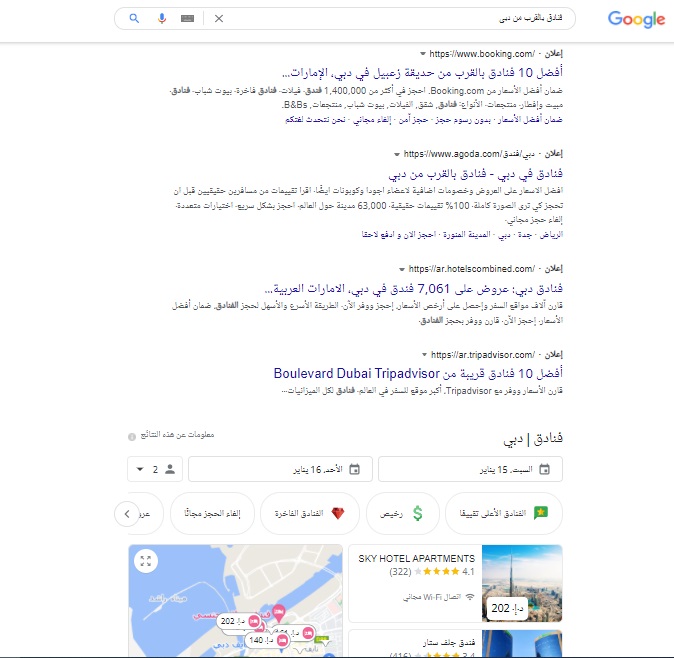

For our last search let’s look outside Dubai for a Dubai related keyword “Dubai Hotels”.

It appears that hotels are one industry that gets a lot of reviews in Dubai. Above we see one hotel even has 2.5k reviews! We also see ads for the first couple of results followed by other hotel review sites and hotel booking sites.

Arabic search results for the same keyword were also similar.

Dubai Mobile Search Results

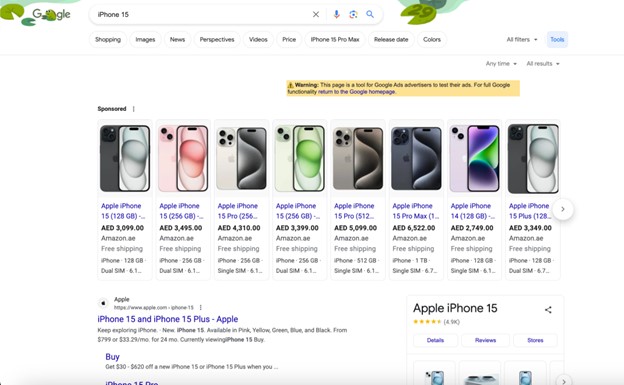

Mobile Search Results in Dubai are very important with such a large smartphone penetration in the region. Here is a snapshot of one set of results on an iPhone 15.

It’s important to note that from the snapshot above we see that there are literally no organic search results showing up above the fold of the page on one of the largest mobile devices available. This means that for some industries it’s going to be very hard to compete in the arena of mobile search if you are not doing paid search ads in addition to SEO.

This is not the case for every single industry, but for industries where mobile searches are common and there is a high level of competition, it appears that in Dubai paid search is a must. To add to this if you’re not in those top three spots, which might be very pricey, your chances of attracting a visitor for a search query like this are low.

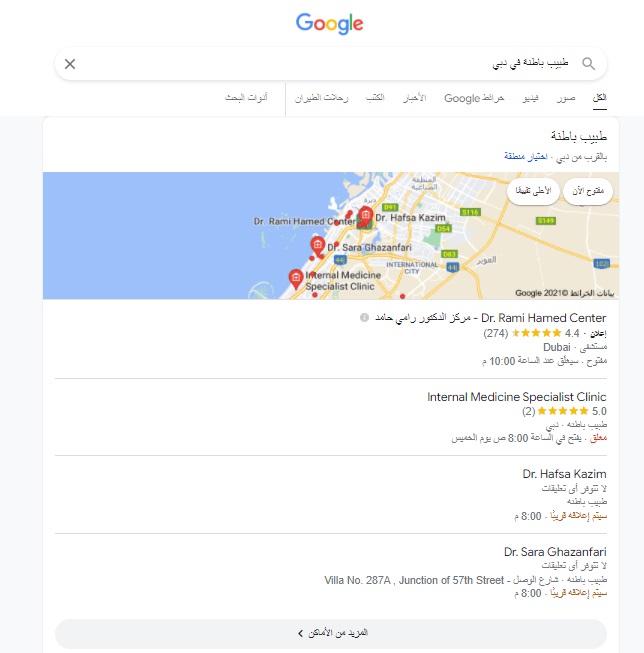

Above we see the results from an Arabic search query for an internist. In this case there’s only one advertiser so it makes much more sense to optimize for the organic results in this case. We also did the search in English, for which we didn’t include the snapshot for. The search revealed that there was also only one advertiser but many organic results showing up with Google’s standard 3-pack and a map.

Given the fact that Dubai is such a tech-savvy city with a large number of mobile users most companies can’t afford not to have a mobile-friendly site and now Google has made this even more of a priority. If you plan to get mobile traffic in Dubai, we strongly recommend having a mobile-friendly site.

It appears that the results you will get on mobile vary based on language and industry. Each company should look at the keywords that are relevant to its industry to determine how they can best effectively show up for relevant search queries in Google results. For some industries, this may mean having to pay Google Adwords to show up in the top positions but for others, it’s enough to rank well in organic search results, especially in Arabic where there is much less competition in Dubai.

Seasonal Search Engine Opportunities

Many SEOs think about seasonal opportunities as a great time to take advantage of large spikes in search volume that can be captured around seasonal search queries. Here are some of the holidays in Dubai where there can be seasonal search volume spikes for certain goods and services.

While UAE National Day and Commemoration are both national non-religious holidays, Eid Al Adha, Ramadan, and Eid Al Fitr are Islamic holidays. However, don’t think that just because they are religious holidays that advertising around them can’t be lucrative. Shopping is a big part of many of these holidays, and studies show that especially during Ramadan and around Eid Al Fitr spending goes up by massive margins in the Middle East. The last holiday on our list is White Friday, which is the equivalent of Black Friday in the US. This holiday was started by the Souq.com founder Ronaldo Mouchawar back in 2014 and has proved very lucrative in the years since.

Note: Dates for the Muslim holidays change each year to make sure to check for the most recent dates in 2024.

Dubai News Results

Getting accepted into news the news results section of Google.ae is similar to getting accepted into news results outside of Dubai. Here are Google’s news guidelines. There are a few important things to note though about Google news search results in Dubai.

- Google will tend to favor local news websites and websites that are popular destinations for locals even when they are from outside Dubai and the UAE.

- There is far less competition to show up in Google news results in Arabic than there is in English. This is mostly due to a lack of optimization knowledge by many Arabic publishers, fewer Arabic publications, and a lack of adherence to Google’s quality standards in many cases.

Dubai Image Search

Getting images to rank in Google.ae isn’t really different from getting them to rank in other places around the world. Alt texts are key so Google can know what the images are about. The authority and relevance of your website and content around images can also help make the images on your website show up in Google search results for a variety of keywords. The one exception to think about with Dubai is that there are certain images that may be censored, but this has little to do with how they rank.

Social Media Impact on Dubai SEO

Contrary to what many people believe there is no clear evidence that shows social media has a direct impact on SEO, though it can have a tremendous indirect impact. This is no different in Dubai. With an internet penetration rate of 99%, social media usage rates are also extremely high. The most popular sites in Dubai are Facebook, Instagram, and TikTok. If your website content is popular on social media it can get shared and discovered by other websites who then can link to that content which can result in improved search engine rankings.

Another important aspect of social media use in Dubai is WhatApp, which actually ranks higher than any other social media site in the UAE with nearly 80% of the population who uses the internet being active WhatsApp users. You might not think of WhatsApp as a social media platform but since it’s owned by Meta it proves to be a strong tool for advertising: brands can link their websites or other social media pages to WhatsApp for direct chats or FAQ related customer service, it is even possible to conduct purchases through the app.

Geo-targeting Opportunities

In addition to targeting Dubai as a city as a whole, some types of businesses might find it useful to get more granular with their targeting to target specific areas of Dubai that are relevant to their target audience. Below we list some of the main areas of Dubai worth targeting. Businesses looking to target these areas with their SEO efforts should think about using the area name in their website copy or get an address in the area that they list on their website.

- Dubai Airport Free Zone

- Dubai Cars and Automotive Zone

- Dubai Healthcare City

- Dubai International Academic City

- Deira

- Bur Dubai

- Jumeira

- Sheikh Zayed Road

- Downtown Dubai

- Dubai Marina and the Palm

- Dubai Internet City

- Dubai International Financial Centre

- Dubai Knowledge Village

- Dubai Media City

- Dubai Gold and Diamond Park

- Dubai Multi Commodities Centre

- Dubai Silicon Oasis

- International Media Production Zone

- Jebel Ali Free Zone

- Dubai World Central Business Park

As you can see above there are a variety of areas to target within Dubai. As a modern city that was built on the idea of attracting business and global attention Dubai developed themes for several areas within the city. Below we go into detail about a few of these areas that might be of significance to your business.

Dubai Internet City

Dubai Internet City is the location of the majority of the internet companies in Dubai. Many businesses that are established in the Freezone don’t have to pay taxes for the first 50 years the company exists and aren’t required to have a local owner. Businesses looking to target other internet companies including local offices of giants like Facebook, LinkedIn, and Google would do well by targeting this district with their SEO efforts.

Dubai Media City

Dubai Media City has now become the center of Media Activity in the region. It is also a free zone and is filled with Media companies like MBC and CNN. If you’re looking to reach the media industry in the Middle East this is a key location to focus on with your SEO efforts.

Dubai Festival City

Dubai Festival City is not a Freezone like some of the other themed districts of the city but there are a large number of residences, commercial buildings, and even offices in this area.

Dubai Healthcare City

Websites looking to target and get traffic for medical products, services, and content would be wise to target Dubai Healthcare City. This Medical district of the city was intended to attract medical tourists from around the globe. Today in addition to hospitals it also contains businesses and academic institutions relevant to the medical industry in Dubai.

Nearby emirates are worth optimizing for as well

Dubai is not its own country, contrary to popular belief. It is just 1 of several emirates. If you are considering targeting Dubai with your SEO efforts you may want to consider also targeting these other emirates because Dubai is not the only wealthy emirate in the UAE. Below is a list of the other emirates in the United Arab Emirates.

- Abu Dhabi

- Sharjah

- Ras al Khaimah

- Ajman

- Umm al Qaiwain

- Fujairah

Dubai Search Trends 2023

Google Zeitgeist’s annual search trends 2023 report listed the most common search queries in the UAE for 2022 as follows:

Censorship

There are cases of censorship online in Dubai but they are limited to online properties with specific kinds of religious content and content that aren’t suitable for young children. Additionally, Dubai has some laws in place that prohibit an online property from encouraging others to acts of public indecency.

Important Note about Dubai SEO Companies

Though Dubai is the center of much of the Arab media industry, most of the SEO agencies in Dubai are typically staffed with non-Arabic speakers. Typically, these agencies are staffed by Indians, Pakistanis, and Filipinos who have little or no understanding of Arabic and Arab markets. Very few Dubai SEO agencies have a significant number of Arabic speakers on their teams. In light of this, if you are looking to get help with reaching Arabs in the region, you want to look up the agency on LinkedIn and check to see how many Arabs they actually have actively working for them. If it’s two or less, it’s likely their UAE SEO results in Arabic will be minimal.

Conclusion

SEO in Dubai still isn’t very competitive. If you determine that Dubai is a key market for your business, you should find that by implementing some of the tactics we mentioned in this article that you will start to rank better in Google. Please realize that as with other forms of marketing, SEO takes ongoing effort and time to see results. Companies that just briefly test some of the strategies mentioned above without continuing will find their results will be minimal. If you don’t have the time or expertise to execute these strategies, it’s a good idea to hire an experienced agency to help you get the results you’re looking for.

Whether you’re looking for a Dubai SEO agency or just a consultant we’d love to help you rank in Dubai in both Arabic and English.