Saudi Arabia Digital Marketing Country Profile

Summary

Saudi Arabia is a land ripe with digital marketing opportunities. With an internet penetration rate of 99%, there is a high demand for online goods and services. Combined with the relatively high GDP per capita of $32,881 USD in 2024, a very low tax rate and more than 50% of the population under 25 years of age, Saudi Arabia is clearly set to see significant online growth over the coming decade or more. It is also important to note that over a third of the residents of KSA are expatriates from other countries like Pakistan, India, the Philippines, and Arab countries like Egypt. The number of expats has decreased in recent years with a push to replace foreign workers with Saudi nationals.

Basic Information about the Kingdom of Saudi Arabia

Before you start on any online marketing campaign, it’s important to understand the context with which you will be doing your marketing, so here we will outline some basic information about Saudi Arabia.

The country has a total population of 37,989,969 people and from a land mass perspective, it is the third-largest Middle Eastern country. It is extremely oil rich with an estimated 15% of the world’s oil reserves and because of this citizens enjoy an individual tax rate as low as 0% if their income is earned in KSA. This low tax rate helps increase the discretionary income each family has for goods and services that could be purchased online. The Kingdom of Saudi Arabia is also the most stable economy in the GCC with an estimated GDP of $2.697 trillion by the end of 2024.

Saudi is a very conservative society rooted deeply in the religious traditions of Islam and the teachings of the Koran. Though this may present some challenges for some types of marketers, those sensitive to culture can see many opportunities to find unique ways to reach this audience.

In terms of these opportunities, Saudi Arabia’s current economic plan called Saudi Vision 2030 is opening up a wide range of new avenues for savvy international businesses and investors to pursue. The goal of Saudi Vision 2030 is to reduce the country’s reliance on oil for revenue, and boost the private sector by encouraging international investments and business cooperation. We can expect to see a steady increase in tourism, cultural activities, and a focus on sustainable energy and more environmentally-friendly business ventures in general. Now that the Saudi market is opening up, don’t miss your chance!

Censorship

Despite the great opportunities offered by the Saudi online market, there are a couple things that you should be aware of when considering launching a Saudi-based online marketing campaign, among which is censorship. In 2007 the Saudi Government set up a special commission to guard citizens against illicit content, defamation, and anything against Islamic values and law. Since that time, more than half a million websites have been blocked.

Despite the high levels of censorship in the country, Saudi Arabians feel comfortable sharing more online than any other country in the world. In addition to this, VPNs and other forms of software that allow you to browse and visit websites anonymously have become extremely popular. Many of these VPNs allow Saudi Arabians to access websites they wouldn’t be able to access over a standard internet connection from their local ISP.

Saudi Arabia Internet Country Codes

Saudi Arabia has both English and Arabic-based country code top-level domains (ccTLDs) available. Though it may make sense to purchase a domain name with one of these ccTLDs, it should be noted that some of these domain extensions do cost much more than a .com or .org. Also, some of these domains require a physical address in the KSA or a local representative for your organization. For many international companies, it’s not worth buying a local top-level domain from an SEO perspective as we’ve seen many websites rank well on Google in Saudi Arabia with just a .com domain. Also, Arabic domains are not recommended for your main website, the adoption of these domains is not very common, and they present a number of issues for some internet tools.

Country Code Top Level Domains

.sa

.السعودية

Second Level Domains

.com.sa

.net.sa

.med.sa

Most popular sites in Saudi Arabia

Saudis spend a great deal of time on the web. Below you will find a list of some of the most visited websites in 2024 in the region regardless of whether or not they are specific to the Middle East or not.

- Google.com

- Youtube.com

- X.com

- Whatsapp.com

- Amazon.sa

- Google.com.sa

- Chatgpt.com

- Madrasati.sa

- Facebook.com

- Instagram.com

- Microsoftonline.com

- Iam.gov.sa

- Temu.com

- Olympustaff.com

- Tiktok.com

Most popular region specific sites

Below is a list of the top regional websites, i.e. sites that are specifically geared to the region and Arabic speakers:

- Haraj.com.sa

- Google.com.sa

- Amazon.sa

- Iam.gov.sa

- Moe.gov.sa

- Sab.org

- Kooora.com

- Moh.gov.sa

- Madrasati.sa

- Argaam.com

- Noon.com

- Nahdionline.com

Saudi Arabia E-commerce

Saudi Arabia is the largest e-commerce market in the Middle East. When it comes to physical goods that are bought in Saudi Arabia, about 60% of goods are bought using payment methods other than a card: either cash or some other digital payment method like PayPal or Apple Pay. Though cash used to be the dominant payment method, digital payment transactions in the Kingdom are increasing rapidly. Currently, around 80% of the Saudi population has a bank account, and around 21% of Saudis use credit cards.

In 2024, electronics items were the most popular purchases made online, with fashion coming in next. Groceries and home goods are also among the most commonly purchased goods online.

The exciting thing about the Saudi Ecommerce market is the fact that it is already a decent size market, but the next decade appears to hold huge growth as the majority of the population starts opening up to online commerce.

Ecommerce companies that have been successful in the region and that have a strong digital presence include:

- amazon.sa

- Noon.com

- Haraj.com.sa

- Cobone.com

- Temu.com

In 2024, the average Saudi online shopper spent USD $286 a year with e-commerce sellers, expected to rise to USD $434 by 2027.The amount of people purchasing goods on the internet in Saudi Arabia is also growing: at just over 22 million people in 2023, this is an increase of almost 600 thousand compared to the previous year. The Saudi Arabian e-commerce market is currently worth USD $10 billion, and estimated to reach a value of USD $17 billion by 2027. According to user surveys, there are a couple factors encouraging growth in the Saudi Arabia ecommerce market, chief among those are free delivery incentives, with nearly 56% of online shoppers reporting that this offer would push them to complete an online purchase. Other popular incentives include coupons and discounts, as well as the option to pay cash upon delivery.

Another key market that is seeing an upkick in online sales recently is travel and tourism: having taken a hard hit during the pandemic, this sector is now quickly regaining its place in the Saudi Arabian online marketplace. The specific travel markets with the most significant yearly growth in online sales were car rentals at USD $609.8 million, hotels at USD $1.95 billion, and flights at USD $7.73 billion, representing a whopping increase of 229% from 2023.

Due to fears of internet fraud in Saudi Arabia, the Saudi Government set up a program to verify the legitimacy of websites in Saudi Arabia called Maroof. Many of the top websites in Saudi like Amazon.sa are registered with the website. Websites looking to do business in Saudi should consider registering with Maroof although it isn’t required.

Search Engine Marketing in Saudi Arabia

As of 2024 Google owns the lion’s share of the search engine market in Saudi Arabia. Depending on the source of the information, Google’s market share ranges from 95-97%. Regardless of the percentage, Saudi Arabians tend to be extremely loyal to brands once they have an established stronghold so it may be very hard for the competition to take any market share away from Google any time in the near future. In 2023 Bing started to gain more popularity with the introduction of Chatgpt into its search engine.

What were Saudis searching for in 2022?

Below is a list of the most common search queries in Saudi Arabia during 2024.

1) ترج

2) ترجمة

3) منصة

4) يوتوب

5) منصة مدرستي

6) ابشر

7) يتب

8) نظام نور

9) مدرستي

10) قياس

State of SEO in Saudi Arabia

The Kingdom of Saudi Arabia has the most number of searches in the Persian Gulf region. Less than a quarter of those searches happen in English, so Arabic is the dominant language in SEO.

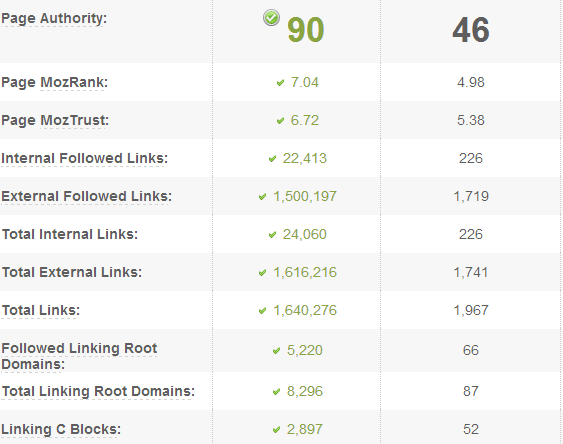

Below you can find a comparison of SEO metrics for the top position websites ranking in the US and Saudi Arabia, respectively for the keywords “Hotels” and “Cars for Sale” in Google. We have made these comparisons in order to provide insight into the SEO competitive landscape in Saudi Arabia when compared to a much more competitive market.

Your price format cheat sheet for Arab currencies. Download now.

Hotels in USA VS. Hotels in KSA

Cars in USA VS. Cars in KSA

Comparison Explanation

Comparing the domain authority and other metrics of the top websites in Saudi and the US, respectively gives us a good general understanding of the number and quality of backlinks a website would need to rank well in the KSA for the most competitive terms. Judging from what we see above a website can rank very well in the KSA with a very limited number of quality links and a relatively low domain authority. This means that companies looking to embark on SEO efforts in Saudi Arabia will find that they need far fewer links to have success and rank well than they would require in more competitive markets around the world.

With that said it is often much harder to acquire links from within Saudi Arabia than it would be to acquire them in many other markets. Why is this? Little attention is given to citing sources properly even on large Arabic publications in the region. Since publishers and writers feel comfortable taking information from other sources without citing it they will usually fail to link back to the source of that information. What is important to remember here is that other websites face the same challenges in acquiring links naturally so even a small success with gaining some regional links can have a very positive impact on your English and Arabic SEO campaigns in Saudi.

State of paid search in Saudi Arabia (PPC)

Pay-per-click advertising in Saudi Arabia is still not competitive in most niches. Still, over the past couple of years, the low cost of PPC ads on Google in the country has driven many websites to open up to the idea of advertising on Google. It is worth noting that in some niches like fashion content publishers bid on popular keywords in order to drive visitors interested in reading content to their websites despite the fact that they don’t know if they will ever be able to monetize these visits.

Analyzing the PPC Difference between the US and Saudi Arabia

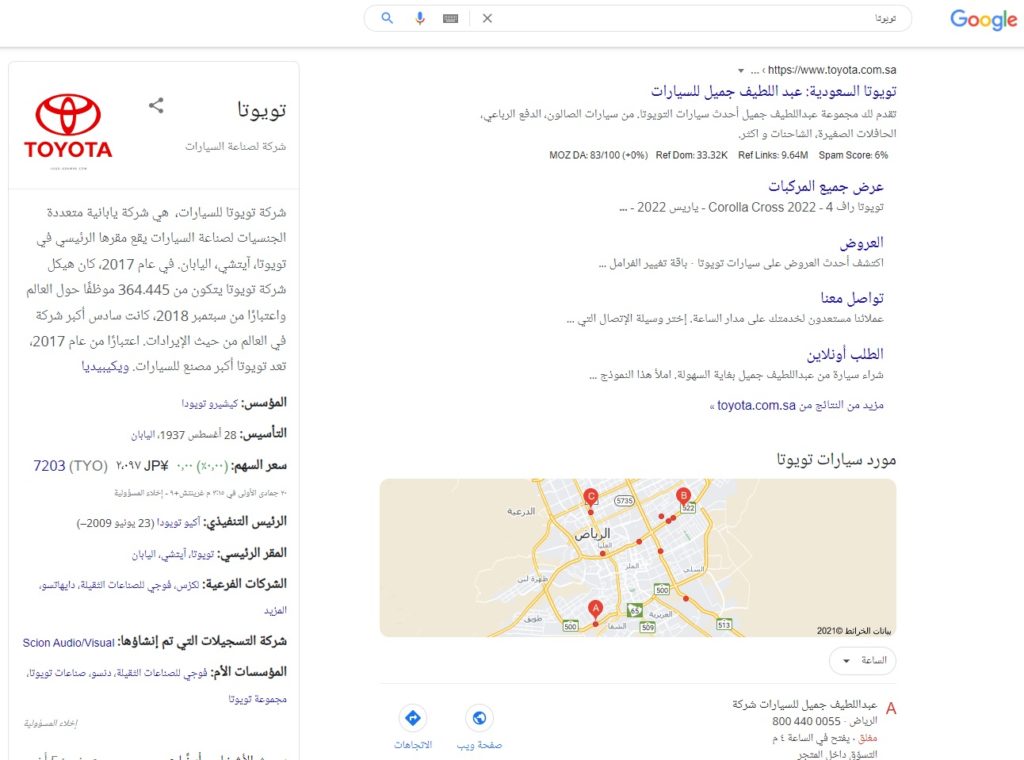

Using google.com.sa we searched for two products that are popular in both the US and Saudi Arabia. We started with the car manufacturer Toyota. When we do the search in Arabic in Saudi Arabia we don’t get any ads, not even a single one.

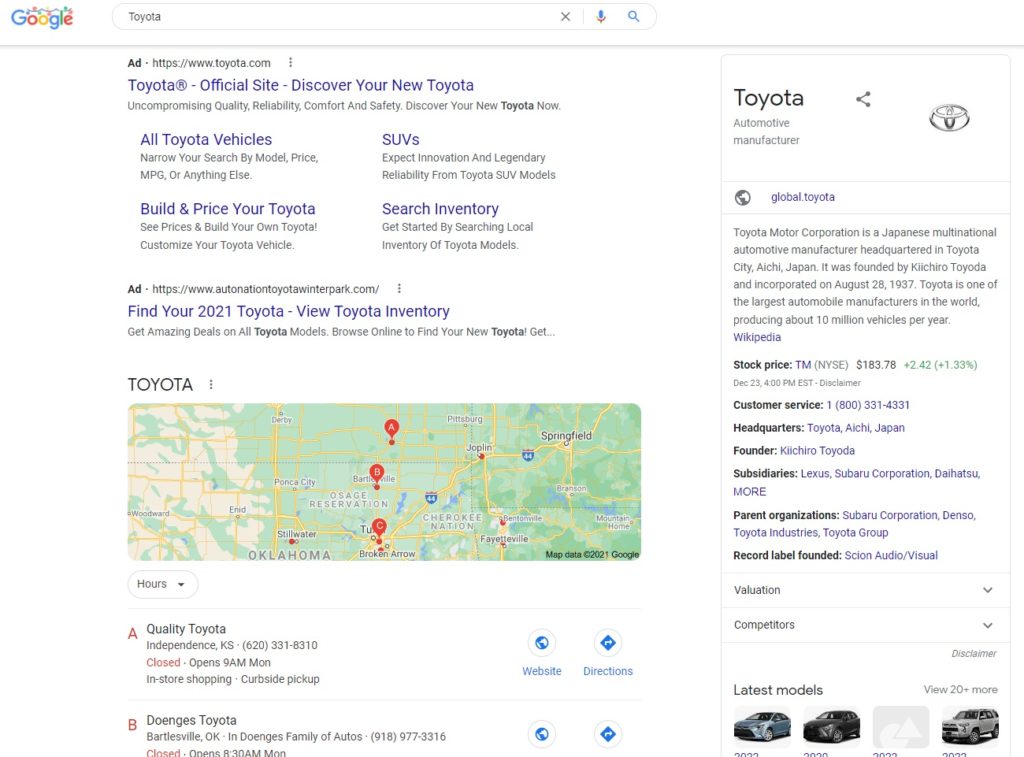

When we do the same search for Toyota in English within the United States we get quite a few more ads than was the case in Saudi Arabia. There are a total of 10 PPC ads on the first page of search results. 3 ads are at the top of the page.

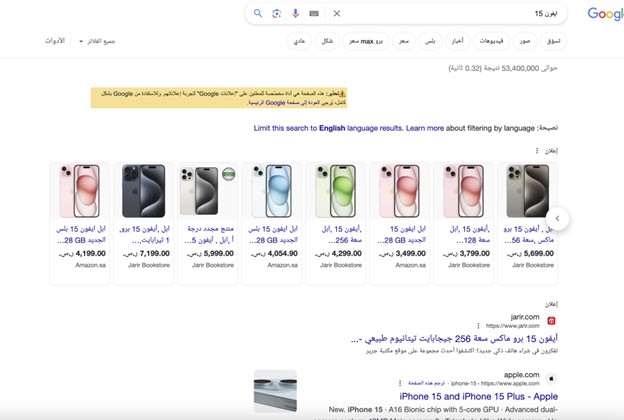

Our second search query was for the new iPhone 15. When we look at the search results for this product in Saudi Arabia, we see Arabic ads from just two sellers, Amazon.sa and Jarir Bookstore, above the organic search results.

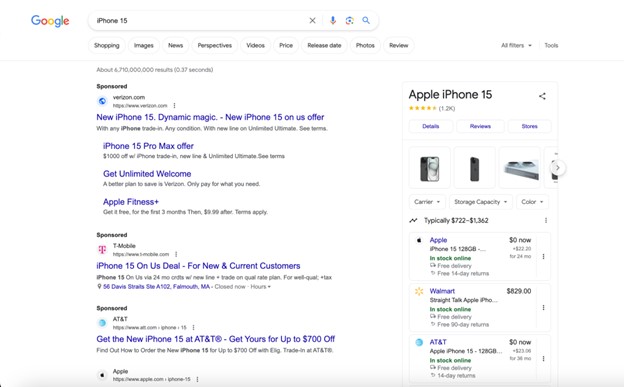

On the other hand, when we do the same search in the US we find that the whole page is full of ads in addition to the product listing ads.

In summary, there are some PPC niches where Saudi Arabia is almost as competitive as other larger markets around the world but in many areas they are far less competitive. Many of the newer ad formats like Product Listing Ads (PLA’s) have yet to appear in the Saudi PPC ad space as well. Earlier entrants into this advertising medium in the KSA will most likely reap the early rewards.

Geo-targeting Opportunities throughout the country of Saudi Arabia

Saudi Arabia is made up of many different cities that can be quite diverse from each other. In light of this, there are many opportunities that can be gained by targeting different cities with a unique digital marketing strategy.

Below is a brief overview of some cities you may consider targeting.

Riyadh

Riyadh is the capital and largest city of Saudi Arabia. With a population of over 7.6 million people, it represents the largest market in the country and should be your first focus in your online marketing efforts. The city has a large middle and upper class and there are plenty of consumers with discretionary budgets available for a wide assortment of products.

Jeddah

Jeddah is a city on the west coast of Saudi Arabia that is considered by many to be the most open and free city in the country. If you are looking to target a demographic that is less conservative and more open to new ideas and concepts Jeddah may be the right place for you to begin some of your digital campaigns in the region.

Al-Medina

Al Medina is the second holiest city in Islam and is one of the holy pilgrimage sites. This makes Al Medina the second largest tourist destination for Muslims. The city itself also has a population of 1.573 million residents. If your business focuses on tourism or you want to take advantage of traffic spikes around the large peak tourist season, Al Medina may be a great place to focus your Internet marketing budget.

Dammam

Dammam is the capital of the Eastern region of Saudi Arabia. Since it is located on the Persian Gulf, it is close in proximity to many of the large cities that are part of the other GCC nations located on the Gulf. If you are already doing a lot of marketing in other GCC countries and want to target frequent visitors to Bahrain, Dubai, and Qatar you may consider targeting Dammam with your marketing efforts.

Mecca

Mecca is the destination for millions of Muslims every year. As the number one holy city of Muslims from around the world, it attracts millions of new visitors every year, from the ultra-poor to the super-rich. Given the influx of visitors experienced by this city every year it may be a great city to market to tourists or the local merchants who benefit from the influx of visitors every year.

Social Media in Saudi Arabia

Social media in Saudi Arabia is booming! Many think that much of the growth in social media within Saudi Arabia has to do with the fact that many things that couldn’t be shared in traditional contexts online can now be shared through social media. In fact, Saudi Arabians share more online than any other country in the world. Social Media has brought many types of freedom to Saudis (especially women) that didn’t exist before the digital age.

In 2024, there were 35.1 million active social media accounts in Saudi Arabia.

Meta sites, Facebook, Instagram, and X (formerly Twitter), enjoy massive popularity in Saudi Arabia. Saudi Arabia has one of the highest X penetration rates in the world at 15.5 million users and ranks number nine in the world in terms of the total number of X users. Instagram and Facebook are also extremely popular, ranking at numbers #7 and #8 respectively in terms of site visits.

While not strictly a social media platform, YouTube is immensely popular in the Kingdom: Saudi Arabia is the largest user of YouTube per capita in the world.

Saudi is not only the largest user of YouTube but in recent years, Saudi Arabians have been producing a great deal of YouTube content. This Youtube content is on various topics but the most popular form of content would have to be Arabic comedy shows.

When discussing social media, we have to mention TikTok. This video-streaming platform has made a quick but remarkable impact on Saudi Arabians: ranking at #3 for top visited sites in Saudi Arabia in 2024, this site has skyrocketed in popularity taking over Instagram and Facebook in the rankings.

It probably goes without saying, but social media content that resonates with the Saudis the most is in the Arabic language.

Mobile Marketing in KSA

According to Dataportal’s recent report from January 2024, smartphone penetration is 99% of the population in Saudi Arabia. As time passes, smartphone users are becoming more dependent on their smartphones, and it is not uncommon to find Saudi Arabians with more than one mobile phone. Surprisingly some smartphone adopters who are older or from lower classes are having their first experiences with the Internet on mobile, as 97.3% of users access the Internet via mobile devices, and the average daily time users aged 16-64 spent using mobile internet was 4 hours and 23 minutes.

94.3% of smartphone users watch videos on their phones, which gives us insight into why YouTube is so popular and such a great advertising medium in the country. Internet users aged between 16-64 that discovered a new brand or product through search engines were 32% and 29% from ads on social media. The interesting thing was that 56% used social networks, and 51% used search engines when researching brands.

In light of these high numbers, different forms of advertising that are mobile-friendly can be extremely effective. Traditional SMS marketing still works, but new channels that target Arabs while they are browsing the web or watching a video on their smartphone are just as effective, if not more effective.

Online Display Advertising in Saudi Arabia

Saudi Arabia has a variety of online display advertising options. First, as we pointed out above, some of the most popular websites in Saudi Arabia aren’t just focused on the Middle East, many of these websites provide display advertising options that allow you to target users in the Middle East. Whether it’s YouTube, Facebook, Yahoo or others, many of these global sites provide display advertising options that allow you to target Saudi Arabians. Google’s display network also has many outlets you can advertise on through its Adsense network.

Direct media buys are also an option in Saudi Arabia, and many content publishers in Arabic and English in the region will allow you to target Saudi Arabia specifically. These direct media buys can tend to be very expensive, though so it may be worth testing other channels before venturing into direct media buys. Another point is that many Arabic content publishers will only reply to inquiries in Arabic and not in English.

Ecommerce Promotion Holidays in Saudi today

Seasonal promotion opportunities in Saudi have blossomed in the past years as retailers look for more opportunities to attract more revenue via urgency and special offers. Some of the most important e-commerce holidays to consider when selling to Saudis are outlined in the following guides.

Saudi Founding Day

Conclusion

Saudi Arabia is the market with the largest online marketing potential in the region. If you want to get a taste of marketing in the Middle East, Saudi is where to start. Essential ingredients to any marketing campaign in this country are a solid knowledge of Arabic culture, and what online channels are the most effective at reaching Saudis.

Download the Saudi Online Marketing Quick Fact Sheet Here

Are you looking for help with your Saudi Arabian digital marketing efforts?

Other MENA Country Profiles

| Online Marketing in the UAE and Dubai | Lebanon Online Marketing Country Profile |

| Online Marketing in Kuwait | Dubai SEO – The Complete Guide |

| Oman Online Marketing Country Profile | Qatar Internet Marketing |