Ecommerce in Saudi Arabia in 2023

If you’re looking to start up or expand an online market internationally, Saudi Arabia can be an exciting and attractive option. The country is a large and still growing market of eager and Internet-savvy consumers. In this E-Commerce Report, we will take you through the Saudi Arabian market and the advantages and disadvantages of establishing an online market in the region. We will address the business culture, trade growth, mobile market, and recent E-commerce developments in Saudi Arabia.

Table of Contents

Country Background

Business Environment & Trade

Business Culture of Saudi Arabia

Censorship

Trade and Country Growth in Saudi Arabia

The Top 10 Imports of Saudi Arabia

Internet Penetration

The Top 10 Websites in Saudi Arabia

Top Online Market Websites

Challenges to E-Commerce Start-Ups

Benefits to E-Commerce Start-Ups

Hopes of Saudis for Future E-Commerce Developments

The State of Mobile Commerce in Saudi Arabia

Recent Market Growth

Conclusion

Country Background

The Kingdom of Saudi Arabia is a large, young, and thriving desert country in the GCC. Saudi Arabia ranks 47th in the world in terms of population, and over 45% of that population is under the age of 24. Islam is the official religion of the country, and the state follows Sharia law. Although there is a large expatriate community (immigrants comprise over 30% of the population), non-Muslims are denied citizenship. 83.1% of Saudis live in urban areas, with over 6 million residing in the capital Riyadh.

Saudi Arabia’s economy is oil-based, with petroleum accounting for nearly 42% of the country’s GDP. The government has recently been trying to diversify the economy in the wake of large falls in oil prices with private investment in healthcare and tourism industries as well as improvements in telecommunications and natural gas exploration. Saudi Arabia’s GDP as of 2022 was 1.11 trillion dollars.

Business Environment & Trade

In this section, we will examine the business culture of Saudi Arabia as well as various aspects of Saudi Arabian large-scale trade. We will look at the growth rates and scale of imports to measure the demand of the Saudi market as well as the GDP to estimate future states of the economy.

Business Culture of Saudi Arabia

There are a few culture-based business methods that vary between Saudi Arabia and the United States. It is important to be aware of these differences in order to conduct both respectful and efficient business. One crucial difference between business structures in the two countries is the timing of the work week. Saudi Arabia’s weekend was on Thursday and Friday until June 2013, when the country switched to the now-standard Middle Eastern work week of Saturday through Thursday. Saudi Arabia is also considered to have a less rigid and scheduled concept of business than that of the United States.

Building trust between business partners is a crucial component of doing business in Saudi Arabia. Smalltalk is encouraged before discussion of hard business details, and business deals should not be rushed. Meetings are generally scheduled around prayer times (specific times of prayer are typically listed in newspapers). One important cultural difference in business meetings is the concept of personal space.

Saudi businessmen are generally more comfortable with standing very close to who they’re talking with, in a way that may encroach on Western standards of personal space. It’s important to be highly respectful of the business culture by taking the time to get to know business partners, not scheduling meetings too close to a prayer time, and remaining comfortable with a possibly different standard of personal space. A more thorough guide to proper business etiquette in the Middle East can be found here.

Saudi businessmen are generally more comfortable with standing very close to who they’re talking with, in a way that may encroach on Western standards of personal space. It’s important to be highly respectful of the business culture by taking the time to get to know business partners, not scheduling meetings too close to a prayer time, and remaining comfortable with a possibly different standard of personal space. A more thorough guide to proper business etiquette in the Middle East can be found here.

Another crucial component to be aware of in Saudi business culture is the limited role of women. Public interaction between the two genders is very limited in Saudi Arabia. Even in business settings, Western businesswomen may have trouble meeting with a Saudi businessman either without a man present or at all. Businesswomen should be very modestly dressed both in public and indoors. While Western businesswomen are generally accepted into the culture, there is a great deal more mistrust than in business dealings with men. Saudi women make up only about 20% of the country’s work force due to difficulties surrounding women in the workplace – such as a lack of women’s restrooms, the inability of women in Saudi Arabia to drive or walk in public unaccompanied, and general discomfort in interaction between the genders.

Another crucial component to be aware of in Saudi business culture is the limited role of women. Public interaction between the two genders is very limited in Saudi Arabia. Even in business settings, Western businesswomen may have trouble meeting with a Saudi businessman either without a man present or at all. Businesswomen should be very modestly dressed both in public and indoors. While Western businesswomen are generally accepted into the culture, there is a great deal more mistrust than in business dealings with men. Saudi women make up only about 20% of the country’s work force due to difficulties surrounding women in the workplace – such as a lack of women’s restrooms, the inability of women in Saudi Arabia to drive or walk in public unaccompanied, and general discomfort in interaction between the genders.

Censorship

While a majority of countries in the Middle East practice strict internet censorship, Saudi Arabia is perhaps the most proficient in this task. The kingdom uses a filtering system to sort and censor material in two categories: immoral and dangerous. Saudi citizens actively report immoral websites, such as pornography, slurs against the royal family, and gambling. A security committee blocks websites that reflect jihadi or radical ideas. Heated discussions of country politics and debated social norms are also highly censored. This high rate of censorship, however, should not be a deterrent to those who wish to start up an E-commerce business in Saudi Arabia. Censorship in Saudi Arabia is primarily an attempt by the government to promote societal values and protect citizens from radical ideas. According to Freedom Houses’s Freedom on the Net report of 2015, although censorship is strict Saudi Arabia actively promotes economic development and e-services on the web. As long as your website does not offend common social values (e.g. discussions of alcohol, women’s driving, gambling) and avoids mention of weighty country topics (Islamic State, terrorism, etc.) and criticism of the royal family, it will be welcomed in Saudi Arabia.

Trade and Country Growth in Saudi Arabia

Imports and country growth in Saudi Arabia have rapidly declined after an all-time high in 2005, when 222,985 million SAR (Saudi riyals) worth of imports were received into the country. Imports amounted to approximately 101 billion USD in 2018, which reflected a -39.5% decrease from 2014 .

The Top 10 Imports of Saudi Arabia

- Technology (machines, pumps, etc.)

- Vehicles

- Electronic equipment

- Iron and steel

- Precious metals (primarily gold and imitation jewelry)

- Pharmaceuticals

- Cereals

- Medical equipment

- Plastics

On this list of imports, the most rapidly growing Saudi markets were for precious metals, vehicles, and pharmaceuticals. Iron and steel, both as products and in their natural forms, lagged in recent years and showed a nearly 23% decline.

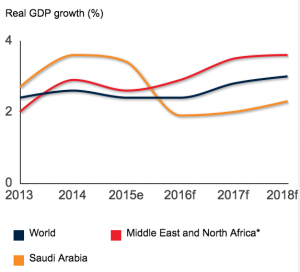

While GDP growth has also been declining in recent years (likely due to lower oil prices across the world), it has not done so at nearly so sharp a rate as imports and country growth. However, WorldBank predicts sharper declines in real GDP growth in the future. Here, we have created a table with WorldBank data describing the past and projected percentages of real GDP growth in Saudi Arabia, compared to the world and the Middle East.

While GDP growth has also been declining in recent years (likely due to lower oil prices across the world), it has not done so at nearly so sharp a rate as imports and country growth. However, WorldBank predicts sharper declines in real GDP growth in the future. Here, we have created a table with WorldBank data describing the past and projected percentages of real GDP growth in Saudi Arabia, compared to the world and the Middle East.

This graph demonstrates a sharp decline in Saudi Arabian GDP growth from 2015 to 2016 with a slow recovery in later years. Please note that this graph shows that the rate at which GDP will increase has declined, not that the GDP itself has done so. Although growth rates are declining now, they are well projected to pick up in the future and the country maintains a robust economy.

Internet Penetration

Internet penetration is extremely high in Saudi Arabia, especially when compared to other countries in the Middle East and the GCC. Saudi Arabia. Approximately 35.95 million Saudis use the Internet – which is about a 99.7% penetration rate.

The Top 10 Websites in Saudi Arabia

Following is a list of the most visited websites in Saudi Arabia in 2023:

Following is a list of the most visited websites in Saudi Arabia in 2023:

youtube.com

google.com

twitter.com

mangalek.com

facebook.com

wikipedia.org

gmanga.org

witanime.com

instagram.com

tiktok.com

amazon.sa

The majority of this list is typical for any country, with Google and various social media pages dominating the list of most visited websites. However, it is also an exciting list for those wishing to invest in E-commerce in Saudi Arabia. Two of the top ten websites – haraj.com.sa and souq.com – are E-commerce websites. Haraj.com.sa is an online auction website and souq.com is a general online store for the Middle East that is much like amazon.com. The presence of these two sites on this list suggests large-scale confidence in online transactions and that Saudis are ready and able to engage in online markets.

Top Online Market Websites

Following is a list of the most popular online markets in Saudi Arabia in 2023:

- Haraj.com.sa

- Amazon.sa

- Noon.com

- Cobone.com

- Aliexpress.com

- Jarir.com

- Extrastores.com

- Alibaba.com

- Opensooq.com

- Markavip.com

Challenges to E-Commerce Start-Ups

In 2020 Saudi Arabia received an “Ease of Doing Business” ranking of 62 out of 190 countries by the World Bank Group. This ranking has dropped sharply in recent years, as well as its ranking in ease of starting a business. This information suggests a lack of simple or fast procedures for registering businesses. It takes an average of 19 days and 12 procedures to start a business in Saudi Arabia.

This difficulty in opening e-commerce start-ups in Saudi Arabia is largely due to a lack of regulations and business frameworks in the kingdom. This lack makes it difficult to locate reliable shipping services, ascertain that a website is in accordance with Saudi law, or pay customs. Though the public has a great interest in e-commerce entrepreneurship and opportunity, it is hard to begin without knowledge support from others.

Benefits to E-Commerce Start-Ups in Saudi Arabia

A recent study on media and Internet use in various countries in the Middle East by Northwestern University in Qatar demonstrated that while E-commerce in Saudi Arabia was growing slowly, it showed great promise for future market expansion. This study estimated that approximately 8% of the Saudi population regularly bought items online, 6% used online banking services, and 7% made travel reservations on the Internet. While these seem to be low numbers, they demonstrate that Saudi Arabia clearly outperforms other countries in the Middle East in terms of building trust in online markets. In fact, the Kingdom was ranked the second largest market for E-commerce in the GCC in 2013 after having received $520 million in online sales in 2011.

The continuing growth and success of the Saudi E-commerce market over other Middle Eastern markets is largely attributed to greater amounts of trust in online payment systems. Saudis report low amounts of fear in using credit cards, and have access to a wide variety of payment gateways (PayPal, CashU, etc.) to ensure that their money is secure.

Mastercard, in their 2014 Online Shopping Behaviour Study on Saudi Arabia, found that nearly 50% of its survey respondents had used the Internet for shopping and that 80% of those were “highly satisfied” with the experience and quality of the market. They also found that although around 45% of online shopping in Saudi Arabia is conducted through foreign websites, Saudis are increasingly looking to local sources. These statistics all indicate that Saudi Arabia has both the foundations necessary for successful E-commerce and the promise of a budding market.

Hopes of Saudis for Future E-commerce Developments

In a 2014 study conducted by Mastercard, Saudi survey respondents indicated what they would like to see in the future that would further motivate them to do their shopping on the Internet and explained when and why they made decisions to shop online or in stores. Consumers cited three major concerns when deciding whether or not to purchase online: the reputation and seeming trustworthiness of the website, the reputation and security of the payment platform, and the value of the items. If the website had been recommended by other Saudis or was known to be legitimate, and if it used a financial platform such as Paypal or CashU that was familiar to Saudis, citizens were more likely to buy. The most commonly bought items were airlines, travel expenses, grocery and home products, electronics, and clothing.

Consumers cited three major concerns when deciding whether or not to purchase online: the reputation and seeming trustworthiness of the website, the reputation and security of the payment platform, and the value of the items. If the website had been recommended by other Saudis or was known to be legitimate, and if it used a financial platform such as Paypal or CashU that was familiar to Saudis, citizens were more likely to buy. The most commonly bought items were airlines, travel expenses, grocery and home products, electronics, and clothing.

However, a major deterrent to E-commerce growth in Saudi Arabia has been reliance on an unreliable and costly payment method.  Many Saudis prefer – due to mistrust in payment platforms – cash delivery methods through which they order goods online and pay at their doors. This trend is frustrating for online markets – Namshi, a fashion website, reported that they found on average a 40% return rate – clearly an unsustainable business model. Over 90% of their business came through cash-on-delivery sales. To create a successful E-commerce market targeting Saudi Arabia, it will be necessary to really emphasize the trustworthiness of both the website itself and of the payment platform.

Many Saudis prefer – due to mistrust in payment platforms – cash delivery methods through which they order goods online and pay at their doors. This trend is frustrating for online markets – Namshi, a fashion website, reported that they found on average a 40% return rate – clearly an unsustainable business model. Over 90% of their business came through cash-on-delivery sales. To create a successful E-commerce market targeting Saudi Arabia, it will be necessary to really emphasize the trustworthiness of both the website itself and of the payment platform.

Saudis also indicated their hopes for developments that would make online shopping more accessible and favorable to brick-and-mortar stores. Around 55% of the consumers surveyed by MasterCard suggested that lesser delivery fees would greatly increase their likelihood of shopping online. Ease of additional service charges and streamlined, intuitive transaction methods were also considered important areas needing improvement. Though reliable product delivery to Saudi Arabia could be costly, the ability to offer that service for minimal fees could be a major factor that would drive Saudis to prefer one site over another. Another interesting insight from the survey claimed that Saudis are more likely to buy from environmentally responsible producers. In general, however, Saudis greatly desire e-commerce developments that will create websites and online markets that are trustworthy, easy to use, and without high service fees.

The State of Mobile Commerce in Saudi Arabia

According to MasterCard’s “Mobile Payments Readiness Index” on Saudi Arabia, Saudi Arabia has a willing environment for mobile commerce but is lacking in the infrastructure necessary to make this transition from cash payments. MasterCard claims that while many Saudi Arabians are already familiar with and using mobile payment methods, banks and mobile network operators in the country have not made the necessary collaboration to promote an efficient mobile payment system. Although Saudi Arabians do over 75% of the country’s grocery shopping on their phones – likely due to lack of mobility – other goods are not bought over mobile due to high delivery charges and lack of trust in payment methods. There has been a 35% growth in the number of Saudi citizens who do their grocery shopping online, according to a recent study by an e-grocery start up in Saudi Arabia called Todoorstep.com. Todoorstep.com estimates the market for online grocery shopping methods to be approximately SR 430 million a year. This information helps to demonstrate that the issue is not consumer willingness, but the lack of a responsive system promoting a high rate of mobile payment platform penetration to match the very high Internet and mobile phone penetration rates.

This information offers hope for marketers able to introduce mobile platforms that are trustworthy and easy to use into their online markets. MasterCard argues that if these systems were more present, they would be used more frequently by Saudi Arabians. The argument is supported by the recent trend of “Instagram E-commerce” in Saudi Arabia – where Gulf citizens use the reliable platform of Instagram to buy and sell handmade goods. Because Instagram has a reliable payment platform, it is trusted and increasingly used by Saudis as an online shop – even if it was not meant as one. In short, Saudi Arabians would be enthusiastic about the ability to shop from their phones if they had a more reliable way to do so.

Saudi Arabia has planned enormous infrastructure developments in the future designed to improve payment gateways. The country has recently raised their broadband penetration level to 22% in areas previously unable to receive service. Saudi Arabians are reported as very active users of the Internet and of their mobile devices. Hope of more efficient infrastructure in the future and the eagerness of Saudis to actively use their phones to shop gives us an optimistic outlook for huge growth of mobile commerce in a short time.

Saudi Arabia has planned enormous infrastructure developments in the future designed to improve payment gateways. The country has recently raised their broadband penetration level to 22% in areas previously unable to receive service. Saudi Arabians are reported as very active users of the Internet and of their mobile devices. Hope of more efficient infrastructure in the future and the eagerness of Saudis to actively use their phones to shop gives us an optimistic outlook for huge growth of mobile commerce in a short time.

Recent Market Growth

Market reports on E-commerce in Saudi Arabia have been overwhelmingly positive both in terms of recent growth and future prospects. Though the banking infrastructure for mobile payments is poor, banks have begun to offer incentives and special products for customers that shop online to encourage the use of bank cards. Saudi Arabia ranks highest in the Middle East for E-commerce market attractiveness despite the popular cash-on-delivery system and lack of trust and efficiency in payment platforms. This is due to high Internet penetration, a young, dynamic, and rising population, and eagerness to utilize mobile phones to shop online. Almost 67% of Saudi participants in the online market are under 35, according to a 2014 analysis by visa. The same study estimated Saudi Arabia’s market growth between 2013 and 2014 to be around 43%. Technological developments and increased communication with global and local online retailers have recently led Saudi Arabia’s E-commerce market to be valued at approximately SR15 billion annually. Wamda has found that more Saudis engage in the online market through investing in stocks, buying goods, and paying for goods than any other Arab population.

Ecommerce Promotion Holidays in Saudi today

Seasonal promotion opportunities in Saudi have blossomed in the past years as retailers look for more opportunities to attract more revenue via urgency and special offers. Some of the most important e-commerce holidays to consider when selling to Saudis are outlined in the following guides.

Saudi Founding Day

Conclusion

Though conducting business in Saudi Arabia presents certain challenges, such as adaptation to a new business culture, lack of infrastructure for registering businesses and establishing mobile payment platforms, and high levels of censorship, there are great benefits to investing in the quickly expanding E-commerce market. The market is projected to rise greatly in value in the next few years and offer a speedy and large return on investment. Start-ups and expanding businesses can feel confident in expanding into Saudi Arabia today.