Oman Digital Marketing Country Profile

Summary

Oman provides exciting opportunities for start-up and low-budget companies to quickly and easily gain a foothold in the online market, in addition to already well-established organizations. With a rapidly growing and modernizing population and a sky-high internet penetration rate of 97.8%, Oman gives savvy marketers the potential of rapid profit and growth. This marketing profile will outline the context of the Omani market, current e-commerce situation, SEO, PPC advertising, and social media in Oman, and the ways in which Oman can benefit and challenge digital marketers.

Basic Overview of The Sultanate of Oman

Understanding the context of the country in which your marketing campaigns are based is a crucial component of targeting your desired population. Here’s some basic information about Oman to get you started.

Oman holds a total population of approximately 4.7 million – nearly 30% of which is composed of immigrants according to data from the UN. This small desert country’s economy is dependent on its oil resources, with revenue from oil currently making up around 30% of Oman’s GDP. This percentage has come down in recent years, as the Omani government actively seeks to diversify and privatize these quickly dwindling resources. Oman recently launched the Oman Vision 2040 Plan, which is an overarching government initiative that sets out multiple long-term goals for the country in order to strengthen and expand the economy, with a strong emphasis on environmental sustainability. In terms of its greater regional role, Oman is a member of the Gulf Cooperation Council (GCC). As of 2024, Oman has a GDP of USD $112.35 Billion and a GDP per capita of USD $21,380 in 2024.

Downtown Muscat, Oman

Though the Omani government does not research or share statistics on the religious affiliations of its population, an estimated 95% of the population practices Islam. Savvy marketers based in the United States should have a good understanding and respect of the values and culture of a predominantly Muslim country while not failing to appreciate the modernity and sophistication of a rapidly developing society, with nearly 87% of the population concentrated in increasingly globalized urban centers. On top of that, Oman also has a significantly young population: with a median age of 28.8 years old, it is no surprise that this country is currently seeing a major uptick in entrepreneurship and tech related startups. This young population that is plugged into global media makes for a great online marketing target audience.

Language

Arabic is the official language of Oman, spoken in the Gulf Dialect. However, the growing expatriate population and the prevalence of English as a second language taught in most Omani schools means that much of the population will speak English as well. Most business conducted in Oman relies on English. The most visited websites in Oman are typically in the English language, with the few sites written in Modern Standard Arabic available in English as well.

Censorship

According to the 2024 2021 “Freedom of the Press” Report from Freedom House, Oman remains one of the most conservative countries in the Middle East in terms of Internet censorship. Oman’s Internet Service Manual specifies a great amount of prohibited content – including false data, elicit or politically charged content, and forums that allow for the voicing of dissent. Though some use VPNS to escape the high-level censorship, the access to these networks has been widely blocked. We’ll discuss how censorship affects advertising in Oman in more detail further below.

Oman Internet Country Codes

Oman provides country code top-level domains (ccTLDs) in both Arabic and English through Omantel, the country’s main telecoms service. However, the use of .org, .net, and .com websites is greater in Oman than the use of these codes outside of government websites. Entities must apply for registration of a .om or .عمان Internet domain under the Domain Names Administration in Oman. New registration has a fee of 25 OMR ( $65 USD), whereas domain name yearly renewal has a fee of just 5 OMR ($13 USD).

Top-Level Domains

.om

.عمان

Second-Level Domains

.co.om

.com.om

.net.om

.org.om

Popular Websites in Oman

This is a list of the current most popular sites in Oman, as per the Ahrefs February 2024 report:

- Google.com

- Youtube.com

- Instagram.com

- Twitter.com

- Whatsapp.com

- Ar.wikipedia.org

- Facebook.com

- Espncricinfo.com

- En.wikipedia.org

- Play.google.com

There are a number of interesting things to note about this list of the most popular sites in Oman. Oman is one of very few countries that ranks google.com over its own country-specific version (Qatar does this as well, but the difference in popularity is much closer). This trend is most likely due to the abnormally high censorship rates in Oman, which prompt many Omanis to intentionally search on google.com and avoid the customization and stricter censorship on google.com.om. Google has recently attempted to stop this habit by making it more difficult to redirect to google.com, after the company received complaints from various countries (France, Canada, the EU, etc.) that they needed Google to comply with their specific censorship guidelines and to expand the Right To Be Forgotten (a ruling that specified that Google had the responsibility to follow European law, specifically data protection rules) to all global domains.

Popular Region-Specific Websites in Oman

This is a list of websites specific to Oman and MENA that are popular among Omani Internet users as of 2024:

- Mawdoo3.com – Arabic-language site with a variety of lifestyle content

- Moe.gov.om – Omani Ministry of Education

- Cricbuzz.com – Cricket rankings

- Altibbi.com – Arabic-language digital health services

- Aljazeera.net – Arabic-language world news

- Opensooq.com – E-commerce

- Youm7.com – News site

- Savefrom.net – Video downloading site

- Yalla-shootc.com – Soccer streaming

- Nl7za.com – Saudi Arabia-based news

An interesting pattern to take note of in this list is that even among region-specific sites in Oman, .com and .net sites are generally preferred over .om or .عمان domains, with the exception of governmental sites such as moe.gov.om.

Popular E-Commerce Sites in Oman

Oman has been gradually opening itself in recent years to both online and mobile e-commerce. According to Muscatdaily, Oman’s e-commerce market is expected to record more than 20% average annual growth between 2021 and 2026. Oman’s current e-commerce market is valued at USD $391.7 Million, with a growth rate of 7.3% since just last year. It’s also worth noting that the Ministry of Commerce, Industry, and Investment Promotion is continuously influencing people to adopt e-commerce for shopping, import, and other activities. The most popular e-commerce sectors in Oman are Electronics, followed by Hobby and Leisure, then Fashion, Furniture, and Grocery.

Following is a list of some of the most popular e-commerce websites in Oman 2024:

Amazon.com

Ebay.com

Aliexpress.com

Opensooq.com

Namshi.com

Shein.com

Search Engine Marketing in Oman

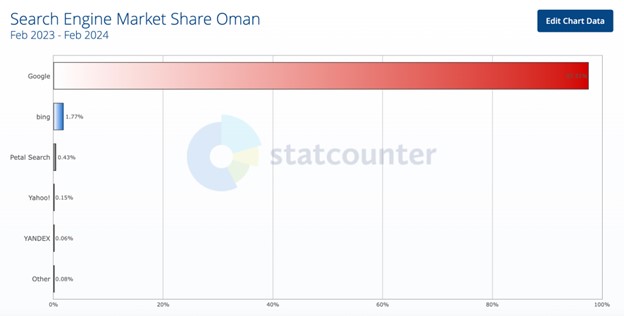

Whether Omanis are on google.com or google.com.om, Google receives a great deal of use in the country every day – holding about 97% of the market share for search engine use in Oman in 2024. Yahoo.com and Bing.com also receive a certain amount of use, but make up less than 3% of the market share. In contrast, Google holds only about 87.6% of the search engine market share in the United States this year – with the other 12.4% split by Bing and Yahoo and others. The great monopoly of Google over searches in Oman demonstrates that there might be little profit in expanding your advertising into other platforms.

Your price format cheat sheet for Arab currencies. Download now.

State of SEO in Oman

Search Engine Optimization is a crucial tool for marketers targeting Oman, where many of the most popular websites are search engines such as Google, Yahoo, and Bing. Here we examine the relative competitiveness of SEO rankings for top ranking websites on Google in the U.S. and Oman respectively through the comparison of very general and highly used keywords – “hotels” and “cars for sale”. These comparisons will be accompanied by brief explanations of what this data indicates about marketing in Oman.

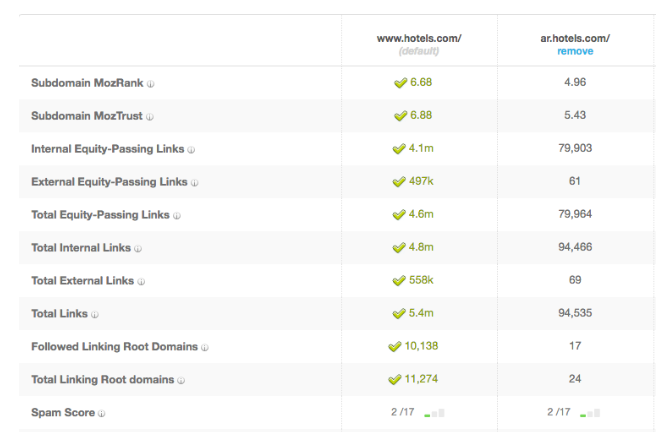

Hotels in USA vs. Hotels in Oman

Interestingly, the top result website (hotels.com) was the same in both searches – on google.com and on google.com.om. The difference was that the Arabic version of the site targeted to Omanis has substantially fewer internal and external links, and less trust in the landing page. This indicates that marketers in Oman may not face as much competition as their ads might in the U.S. – Oman requires far fewer links and less page authority to receive the top placement in their searches, which in general means Oman SEO will be easier.

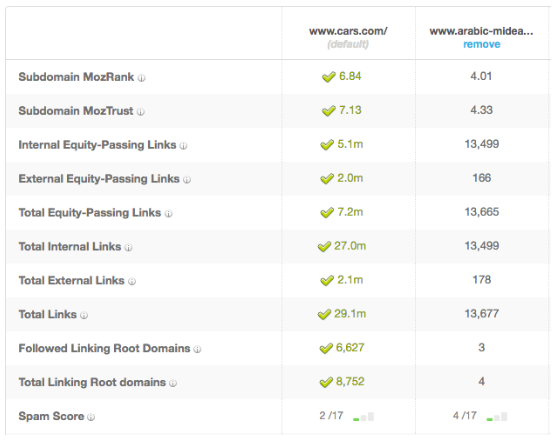

Cars in USA vs. Cars in Oman

This search demonstrates the same trends seen in the earlier comparison – namely, that much less authority and relevancy has to be established in Oman than in the U.S. for a website to gain a top position in paid searches. Marketers operating in Oman face much less competition for desired keywords than they would for running the same advertisements in the U.S.

State of PPC in Oman (Paid Searches)

While broad keywords hold moderate amounts of competition in searches through google.com.om, there is still plenty of room for marketers on a small budget to easily target an Omani audience. Due to little competition, pages do not need as much authority or equity-passing links to qualify for high positions in Google advertising. The low cost and low demands of current PPC advertising in Oman could provide excellent marketing opportunities while the connected Omani market is still growing and developing.

Analyzing the PPC Differences between the US and Oman

To illustrate the lower competition levels in Oman and ease of marketers to establish high-ranking advertising there, we will compare the amount and placement of ads for popular searches between the United States (google.com) and Oman (google.com.om).

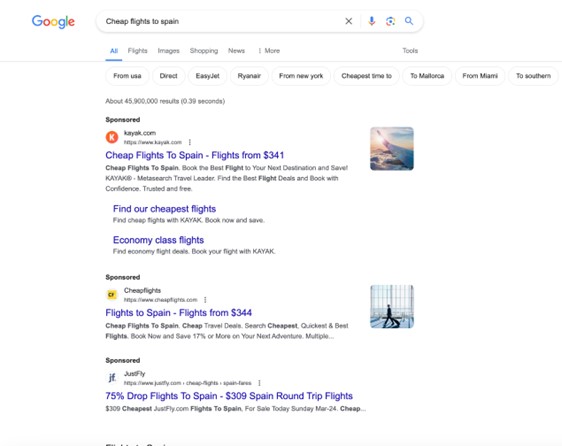

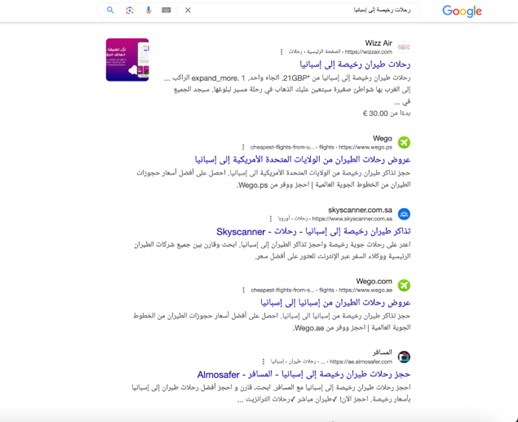

We will start with the search “cheap flights to Spain”, in English for the U.S. search and in Arabic for Oman:

These pages demonstrate the smaller amount of competition in Oman to achieve a top position for an advertising campaign. The same search revealed only no sponsored pages in Oman, whereas the U.S. search shows all 3 spots at the top of the search engine page filled with advertisements from large companies.

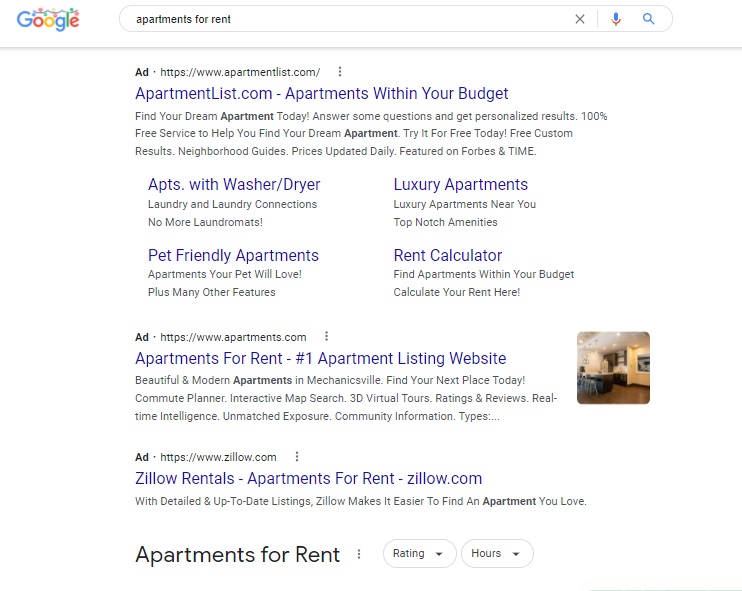

Next, we will search for “apartments for rent” in the U.S. and Oman:

Though there are 3 paid search terms for this search in the U.S., there are none at all in Oman. These searches help to show that the low level of competition, in addition to the low cost of advertising when high-level keywords have little competition and lower bids, can provide incredible opportunities for online marketing in Oman.

Geo-Targeting Opportunities in Oman

Oman is a highly metropolitan area, with the enormous bulk of its citizens residing in Muscat. While Muscat is the center for business and by far the most populated area in the country, some smaller cities do provide substantial business opportunities. In addition, there are districts within Muscat that it can be very worthwhile to target for a more specific audience.

Here are descriptions of places within Oman that could provide substantial return on geo-targeting:

Muscat

Muscat is the capital and most densely populated city in Oman, boasting a population of over 800,000 people and a greater metro area population of 1.4 million. It is by far the largest city in the country, with over 50% of the total population of Oman, and should be any marketer’s first stop for advertising.

Districts in Muscat to Geo-Target

Ruwi

Ruwi is known to be the central business district in Muscat, with the largest amount of Oman’s commercial buildings and banks. Marketers seeking to target a more professional and urban audience should concentrate in this district.

Qurum

Qurum, similar to Ruwi, prides itself on its modernity. It is the touristic center for the city and contains dense concentrations of restaurants, shops, and hotels. Fashion goods and restaurants could be very successfully marketed here.

Muttrah/Matrah

Muttrah is a port and commercial city within Oman, where tourists and Omanis flock to for the latest goods and seafood restaurants. Marketers hoping to promote new and exciting goods might have success in this district.

Seeb

Seeb is a smaller city within Oman, populated by just under 240,000 people. It provides a fresh and substantial market outside of the stiffer competition for Muscat.

Salalah

Salalah is the third largest city in Oman, with a population of approximately 163,000. While it is not nearly as populated as Muscat, it still provides a good market for determined marketers as its natural landmarks make it a hub for domestic and international tourism.

Social Media in Oman

As of 2024, approximately 97.8% of Omanis use the internet, with nearly 85% of the population active on social media. With the increasing penetration of Internet use in Oman over the past few decades, there has been a large rise in the popularity of these social networks. Facebook, Instagram, and Linkedin are the three most popular social media websites in the country. Other high-ranking social media platforms in 2024 are Linkedin, Snapchat, X (Twitter), and Pinterest.

Mobile usage reports of social media websites suggest much more loyalty to Facebook, with Facebook creating 54.4% of social media traffic in 2024. Instagram follows Facebook 24.5%, with Youtube coming in third at 9%. This suggests that while there is an eager and growing market in Oman for social media advertising – both on desktops and mobiles – Omanis are generally loyal to Facebook, Instagram, and YouTube and show little interest in other social websites. This trend can present a challenge to marketers who must beat out the significant competition for visibility on these very famous and targeted websites, but also presents tremendous opportunities to savvy marketers able to target and advertise to a specific audience.

State of Mobile Marketing in Oman

Like some of the other Gulf countries, Oman has an extremely high mobile phone penetration rate. Reports from 2024 show more active mobile phone connections than people in the Sultanate. While in-person payment methods are still preferred, mobile payments are on the rise as well. The Central Bank of Oman along with Omantel recently launched applications to facilitate mobile payments and digital card use. These features are good news for online marketers who don’t have a physical presence in the country, as it is clear that Omanis are increasingly turning to the internet for their purchases. However, there are certain features of e-commerce that Omanis certainly prefer, such as quick shipping and the option of paying cash upon delivery. These factors should be taken into consideration with any Oman-based marketing campaign.

As we mentioned above, Omanis are extremely connected to the internet through mobile devices. Mobile phone usage rates increase every year due to the increasing prevalence of user-friendly mobile shopping applications. Subscriptions to mobile data have also been steadily increasing, demonstrating a growing interest in surfing online. This increasing demand for user-friendly mobile forms of marketing could provide a great opportunity for those looking to market and sell in Oman.

In a recent survey on mobile marketing in Oman, Mordor Intelligence indicated that Omani’s still have a general preference for in-person shopping over online shopping, especially for products like clothing and personal care. They claim that Omani culture and mindset has a preference for brick-and-mortar shops. Those they surveyed indicated that it was very important to them to be able to try on, feel, and see products before purchasing them. They also indicated that Omanis preferred a more personalized shopping experience, in contrast to the impersonality of mobile advertisements. Mobile marketers should take this context as a signal to focus and direct any advertising in Oman in a highly specific manner to turn more impressions into conversions.

Online Display Advertising in Oman

Online display advertising in Oman is limited by governmental rules over advertising content. These rules contain guidelines that correspond to the government’s censorship as well as rules that aim for ads to be relevant to Omanis. Article 8 of the Local Ordinance 25 of 1993, which governs advertising in Oman, specifies that all advertisements should be written in Modern Standard Arabic (English may be used if it is next to a correct Arabic translation) and that advertisements must be compliant with public order, morals, and security. Additionally, any ads must not go against Omani customs or religious beliefs, as explicitly outlined in the Article. Clearly, this regulation can make it tricky for foreigners launching display ads, as it may not always be well-defined just exactly what is acceptable and what could potentially be censored. That’s why it’s best to consult with Arabic marketing experts to make sure that your ads are fully appropriate and won’t risk censorship in Oman.

Don’t let these slightly-rigid advertising regulations put you off though: foreign companies are able and encouraged to engage in online display advertising in Oman, which is an important first step for any company hoping to establish a local presence. Only a handful of advertising agencies operate in Muscat, but popular search engines in Oman such as Google, Yahoo, and Bing are available and cost-effective due to this low competition.

Seasonal Promotion Times

Potential opportunities for seasonal promotion advertisements include:

- New Year’s Day (January 1st)

- Al Isra’ wal Miraj (the 27th day of the month of Rajab)

- Ramadan (Date varies based on Islamic calendar)

- Eid al-Fitr (celebration of the end of Ramadan)

- Eid al-Adha (most important Muslim feast day, date varies according to the Islamic calendar)

- Hijri New Year (date varies according to the Islamic calendar)

- National Day (celebration of Omani independence from Portugal, November 18th)

- Birthday of Prophet Muhammad (date varies according to the Islamic calendar)

- White Friday (Lines up with Black Friday in the US/Europe)

Conclusion

Start-up companies with little established legitimacy, as well as companies with smaller budgets for advertising that can’t bid high to receive top positions on profitable keywords, may benefit and gain recognition much more easily in Oman than they would in the U.S. or in similar markets throughout the GCC and Middle East. Oman is a growing market with great potential for marketers who jump on the current opportunities.

Do you need help with your Oman digital marketing efforts?

Contact us today to discover how we can help you and your company.

Other MENA Country Profiles

| Online Marketing in the UAE and Dubai | Online Marketing in Saudi Arabia |

| Online Marketing in Kuwait | Dubai SEO – The Complete Guide |

| Bahrain Online Marketing Country Profile | Qatar Internet Marketing |

Updated by: